John Darer Earns Certified Financial Transitionist Professional Designation

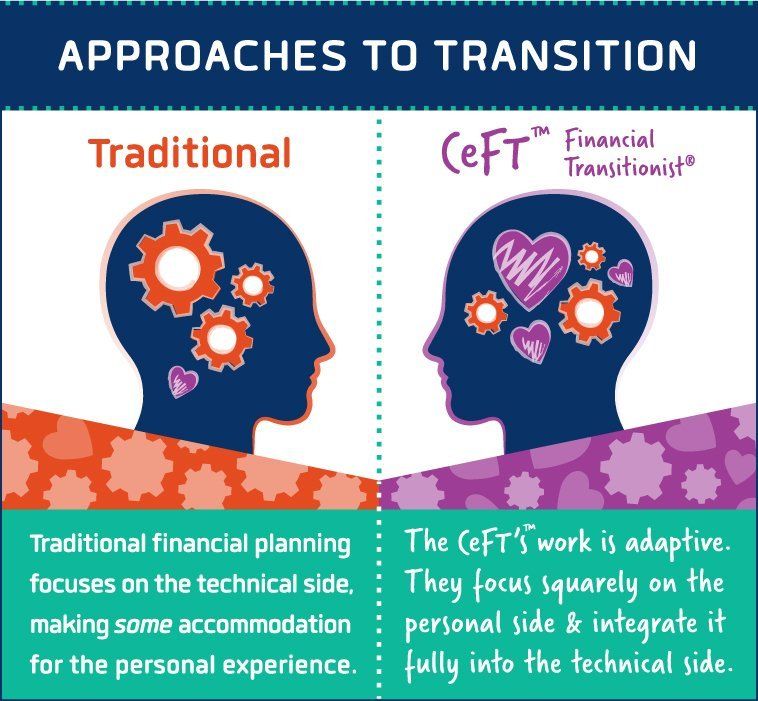

The CeFT is the financial service industry's first designation in the human dynamics of financial change and transition. A CeFT designee recognizes the importance and the power of the personal side of money and the unique challenges of transitions and has a process and science backed protocols for addressing these with clients

A Financial Transitionist® is a professional with an established career in the financial services industry * who recognizes the importance and the power of the personal side of money and the unique challenges of transitions. Financial Transitionists® have a rich and comprehensive understanding of how people subjectively experience change, and are able to co-create their highest outcomes with them.

Financial Transitionists® bring process and tools to their client relationships that are not add-ons. Instead, they are intrinsic to the experience of guiding someone through a transition. Their work is embodied; it’s equal parts what they’re doing and how they’re doing it. And it requires a different kind of listening, a letting go of the seat of authority, and an ability to sit with and through uncertainty. It’s not for the average person and it’s not easy work, but it’s the most rewarding work all of us involved have ever done.

John Darer is one of two settlement experts who have committed themselves through the rigors of the coursework and examination to earn the Certified Financial Transitionist designation. Designees have an ongoing continuing education mandate to maintain fluency. and ongoing ethical requirements.

4structures.com, LLC

The Structured Settlements and Settlement Planning Company

43 Harbor Drive, #309 Stamford, CT 06902 USA

888-325-8640

646-849-1588

New York City (Manhattan, Bronx, Brooklyn, Queens, Staten Island), Westchester(NY), Nassau County (NY) , Suffolk County on Long Island (NY), Albany County (NY), Oswego County (NY), Steuben County (NY), Broome County (NY), Onondaga County (NY), Fairfield County (CT), New Haven County (CT), Hartford County (CT) New London County (CT), Tolland County (CT), Litchfield (CT), Middlesex (CT) , Bergen County (NJ), Middlesex County (NJ), Ocean County (NJ)

Structured Settlement Experts and Settlement Planning Consultants for settlements from claims or lawsuits arising out of Aviation accidents, Medical Malpractice, settlements involving Serious Personal Injury, Wrongful Death, Wrongful Incarceration, Employment, Civil Rights, Discrimination of any type, Auto accidents, Motorcycle accidents, Maritime accidents, Workers' Compensation, Product Liability, Real Estate Liability, Construction Defect claims or lawsuits, Landlord/Tenant,

Property, Attorney Fee Deferrals, Funding Agreements, Structured Installment Sales, Environmental Liability and Commercial Dispute settlements.

Structured settlements and structured settlement brokerage, settlement planning, Sudden Money®, financial transitionist, funding agreements and insurance related services provided by 4structures.com LLC.

Financial Advisory Services provided through Groove Financial Advisors , LLC, and its service partners.

Fiduciary services, including the custody and administration of trusts provided via service partners.

Securities and Insurance Products are NOT Insured by the FDIC, nor by any other Federal or State Government Agency, are NOT a Deposit of and are NOT Guaranteed by a Bank or any Bank Affiliate, and securities MAY lose value.

4structures (USPTO Reg. 4640532) , 4structures.com (USPTO Reg. 4640531) , We Know Structured Settlements (USPTO Reg. 3089738),

Because Certain Sells (USPTO Reg. 6237309) and We Know Structured Sales (USPTO Reg. 3490489), are Registered Trademarks of 4structures.com LLC.

John Darer is a Registered Trademark of John Darer (USPTO Reg. 4674907)

John Darer California insurance license 0761076

4structures.com LLC CA license OF19785 d/b/a 4structures Settlement Insurance Agency