How Certified Financial Transitionist Settlement Planner Adds Value

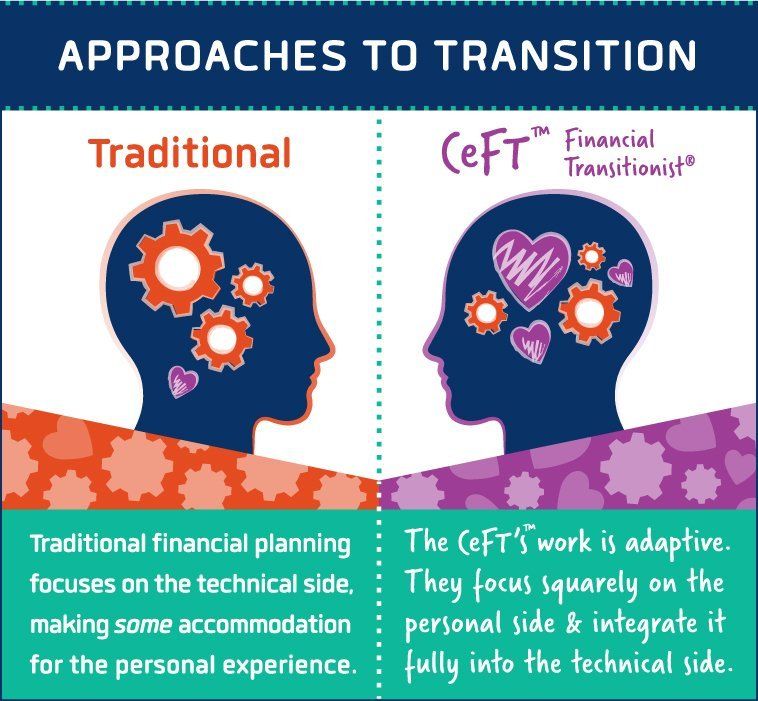

A CeFT recognizes the importance and the power of the personal side of money and the unique challenges of transitions and has a process and science backed protocols for addressing these with clients

A Financial Transitionist® is a professional with an established career in the financial services industry * who recognizes the importance and the power of the personal side of money and the unique challenges of transitions. Financial Transitionists® have a rich and comprehensive understanding of how people subjectively experience change, and are able to co-create their highest outcomes with them.

How Do Settlement Planners who are also Certified Financial Transitionists Add Value to the Settlement Planning Experience?

Financial Transitionists® bring process and tools to their client relationships that are not add-ons. Instead, they are intrinsic to the experience of guiding someone through a transition. Their work is embodied; it’s equal parts what they’re doing and how they’re doing it. And it requires a different kind of listening, a letting go of the seat of authority, and an ability to sit with and through uncertainty. It’s not for the average person and it’s not easy work, but it’s the most rewarding work all of us involved have ever done.

John Darer is one of two settlement experts who have committed themselves through the rigors of the coursework and examination to earn the Certified Financial Transitionist designation. CeFT designees have an ongoing continuing education mandate to maintain fluency. and ongoing ethical requirements.

Last updated November 21, 2024