Life Changing Amounts of Money and Lessons Learned

Kneading Dough is an award winning series, in which superstar athletes discuss life-changing amounts

of money and lessons they've learned, presented by UNINTERRUPTED and Chase. Episodes features

never-heard-before exclusive content and are hosted by former NFL

player, Andrew Hawkins.

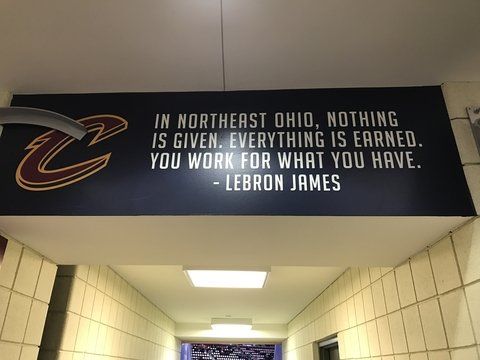

Andrew Hawkins' podcast with Lebron James

is excellent and provides valuable lessons not only for young athletes but, in my opinion, would be helpful and interesting to young adults who come into a windfall from the death of a parent, from a lawsuit or have just discovered that they have a structured settlement from a legal case that settled when they were a young child.

18 year olds in 2019 were probably not even potty trained at the beginning of Lebron James' rookie year. Many of them see an all world elite athlete with the trappings of wealth. Lebron grew up in the projects in Akron, Ohio where he and his Mom struggled to make ends meet. They got by on food stamps. Check this out..

The Importance of Allocation/ Paying Yourself First

Lebron learned a valuable lesson from his uncles. In the Kneaded Dough podcast he says "They'd give me a dollar and they'd be like, 'Listen, nephew, go spend 35 cents of it and keep the other 65.' Or, if they gave me two dollars, they'd be like, 'Go ahead and spend a dollar of it, but stash the other dollar." It's a lesson that has stuck with him. After 12 years, just before signing his first contract at age 18, his stash had grown to $1,700.00

A structured settlement is all about paying yourself first.

You have a " job" for as long as the contract runs, that you can never be fired from

You have stability so you can pursue a college or graduate degree

You have stability while you learn a new trade

You have stability while you start a new business

You have income so that you don't have to share a crowded apartment with lots of people so you can make ends meet.

Just Ask Questions

"

Keep in mind with athletes it's a short window. Just ask questions. When do my checks come? When do I get paid? How much up front?" said Lebron in the podcast.

It's especially important to ask questions if you have a structured settlement and you are a teenager or young adult

If you're 18 and you just found out you had a structured settlement set up by a parent when you were a young child, there are plenty of companies out there that have been stalking you, waiting for you to turn 18 so that they can pounce with a money losing strategy of selling your structured settlement for pennies on the dollar. They won't frame it quite that way, because it would hurt their sales pitch, but that's what it is when you get down to it. Speak to someone who has the credentials and the patience to give you space to safely learn what you have to. Get some real financial advice from someone whose primary way of making a living is not based on trying to pick your pocket for pennies on the dollar. There are specialists called Certified Financial Transitionists

Managing Expectations

Lebron makes a poignant comment about his kids and money "They will never understand bottom, At end of the day they have to walk their own path. Appreciate what you have and realize that it isn't always accessible to you". He also says "Saying no to want or need (harder to identify from those) behind on bills, who make unwise decisions. brought on themselves" Lebron said if he did help someone he would give them " 1/2 what was needed and until they paid in full, no more loans'

I recently spoke with a 25 year old who was targeted and sold a good chunk of her structured settlement payments at 18 for pennies on the dollar. Nevertheless the perception of others around her was that she had this large lump sum and was approached by people about her "new found riches" seeking help. This was a huge misperception for those people, since the structured settlement arose from horrific burn injuries over a large portion of her body, the pain she suffered and will suffer, and the disfigurement. Sometimes its a good idea to take a proactive timeout, what the Financial Transitions Institute refers to as a Decision Free Zone.

Better Shop Around Just Like Your Mama Told You, and now Lebron James

Lebron then gives discusses the importance of shopping around and evaluating different offers related to shoe endorsements. He had a shoe offer from one company as an 18 year old, but had the presence of mind yo see out other offers. The same thing goes to people seeking to raise cash from selling their structured settlement. It's not the greatest move in the world, because yo0u are guaranteed to lose money, but if you have to sell then shop it around. In some cases the differences are life changing,

Rookies Don't Pay For Anything!

Lebron doesn't let rookies pay for anything. He says " don't spend it before you get it." If you're 18 and you just found out you have a structured settlement, just remember you're a rookie. On some teams rookies have to clean the senior team mates boots. With 18 year old and other young adult rookies, the cash now vultures just take them and their structured settlement to the cleaners. Remember you suffered a loss to get that structured settlement in the first place. Now the vultures want you to take another loss.

I look forward to seeing the other athletes stories on Kneaded Dough. I understand that Serena Williams is due on an upcoming show.