Liberty Life of Boston Sale to Lincoln Financial Group

The Important Questions Are Answered Here | What Happens to LLAC Notice of Financial Commitment, LMIC Guarantees | BARCO and more

Q: After Lincoln

Financial Group’s acquisition of Liberty Life Assurance Company of Boston

(“LLAC”) (the “Transaction”) is finalized, what will happen to (1) Liberty

Mutual Insurance Company’s (“LMIC”) Guarantee of LLAC, (2) LLAC’s Guarantee

of Liberty Assignment Corporation (“LAC”), and (3) LLAC’s financial

commitment to BARCO Assignments, Ltd. (“BARCO”)?

(1) LMIC Guarantee of LLAC

The terms of this

Guarantee provide that, in the event of an acquisition of LLAC, the

Guarantee will terminate if after the Transaction LLAC has a S&P and

A.M. Best rating equal to or higher than those issued to LLAC prior to the

Transaction. As a condition to closing the Transaction, the parties have

agreed to confirm with S&P and A.M. Best that the ratings of LLAC have

not been downgraded below “A” or “A”, respectively. Therefore, this

Guarantee will terminate upon the closing of the Transaction.

Please reference the following for the most recent AM Best and S&P

financial strength ratings of Lincoln Financial Group:

www.ambest.com

www.standardandpoors.com

www.lfg.com/public/aboutus/investorrelations/financialinformation/ratings

(2) LLAC Guarantee

of LAC

LLAC will continue

to guarantee all obligations assumed by LAC under qualified assignments

should LAC default. Once the Transaction is finalized, Lincoln Financial

Group will become the sole owner of LLAC and the Guarantee will remain in

effect.

(3) LLAC Financial

Commitment to BARCO

The Net Worth

Maintenance Agreement (“NWMA”), whereunder LLAC ensures the solvency of

BARCO, will remain in effect. LLAC’s obligations under the NMWA, however,

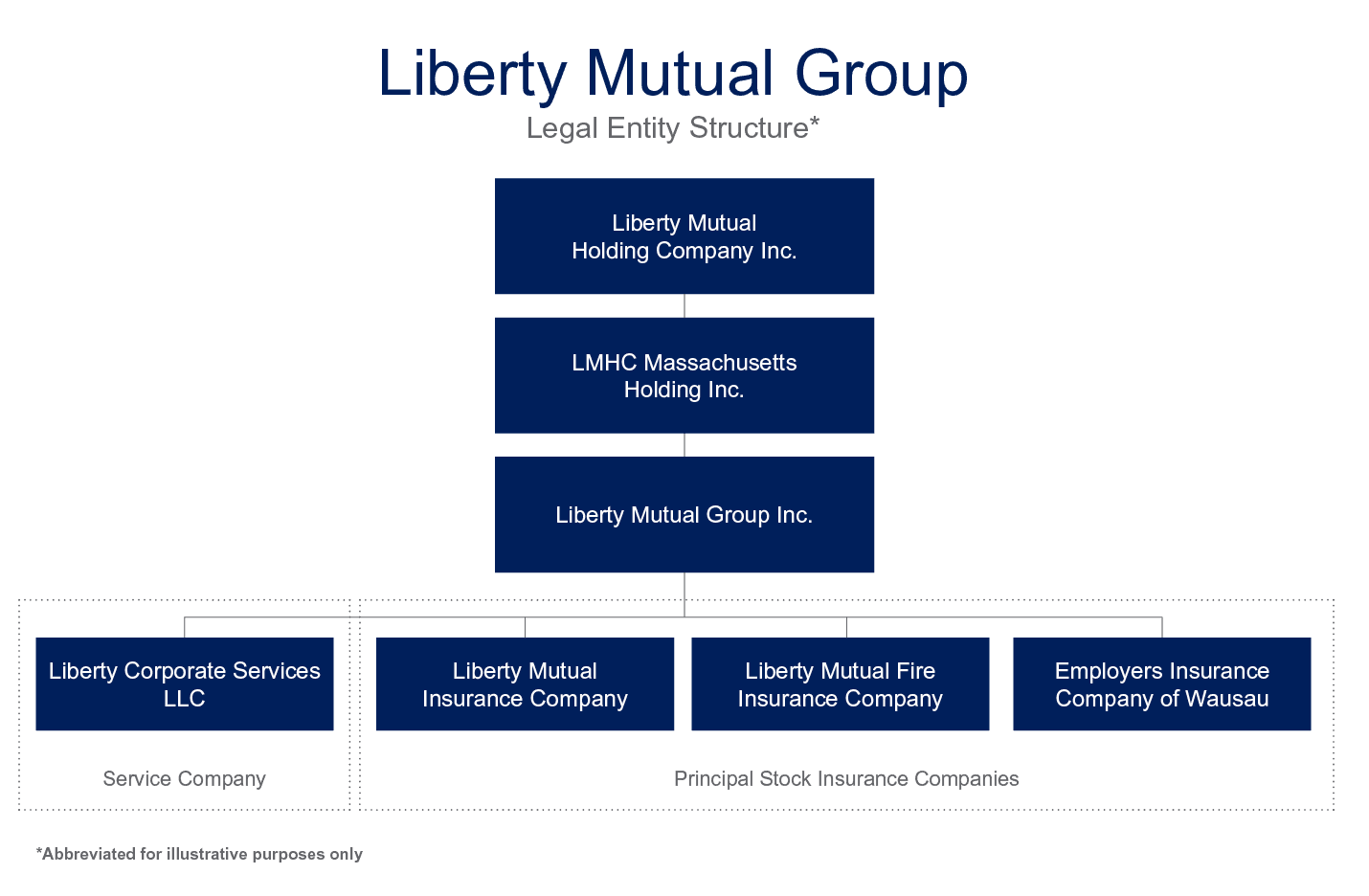

have been novated to Liberty Mutual Group Inc.

Q: What is the

status of BARCO following LLAC’s exit from the non-qualified business and

its acquisition by Lincoln Financial Group?

Ownership

Liberty Mutual

Group Inc. is now the sole owner of BARCO.

Management

Going forward,

BARCO will be managed by Cafico International in Dublin, Ireland. All email

correspondence should be directed to: barco@caficointernational.com.

Barco Assignments, Ltd

c/o Cafico International

2nd Floor Palmerston House

Fenian Street

Dublin D02 WD37

Ireland

#LibertyLifeInsuuranceCompanyofBoston

#BARCO

#BARCOAssignments

#LibertyMutual

#NetWorthMaintenanceAgreement

|