Assura Trust | A Market Based Structured Settlement Option

Balance and Diversification for Long Term Structures

Who is Assura Trust?

Assura Trust is a different kind of trust organization, exclusively serving the needs of injured people and their families. Assura Trust's sole focus is on settlements. More personalized than some large institutions; more expertise than some bank down the block. As a settlement planner, financial transitionist, and structured settlement expert, I can't undo injuries or bring back lost years or loved ones, but I can collaborate with clients and help clients transition from the stressful world of litigation and help empower clients to move forward with financial security and support.

Assura Trust was founded as a subsidiary of Midwest Trust Company, an independent state chartered trust company, based in Overland Park, Kansas, to specifically cater to the concerns and needs of stakeholders in the litigation market

Assura Trust is a blended structured settlement option that is available for both plaintiff structured settlements and attorney fee deferrals

The Assura Trust solution blends a fixed structured settlement payment stream (or streams) from a traditional structured settlement annuity with a "Growth Structured Settlement" (GSS). A Growth Structured Settlement includes a broadly diversified growth portfolio, through a Vanguard or Blackrock growth fund of funds held by Assura Trust. On the Growth Structured Settlement side the funds are disbursed based on a fixed and objective formula.

Watch John Darer's educational video about Market Based Structured Settlements located at the bottom of this page.

How Assura Trust Calculates Payments

How does Assura Trust calculate your payments for the up-coming year? Assura Trust divides the balance in your fund by the remaining number of years of scheduled periodic payments in your settlement. This tells Assura your upcoming full-year distribution. Assura then divides that by the number of payments you selected for each year (twelve for monthly, four for quarterly, etc.) to get your individual payments for the year. If this calculated payment falls below the predetermined baseline payment established at the outset, Assura sends you the higher baseline payment instead Source: Assura Trust website

Click on the Growth Structured Settlement Overview below. The goal of the settlement planning design is to deliver greater possibilities for periodic payment payment streams over long periods of time. Note that Assura Trust has a 20 year minimum. in aggregate with a fixed structured settlement annuity. So for example it could be fixed structure for 10 years and the GSS for 10 years starting in 10 years, or the GSS could sit on top of the annuity with annual distributions for 20 years.

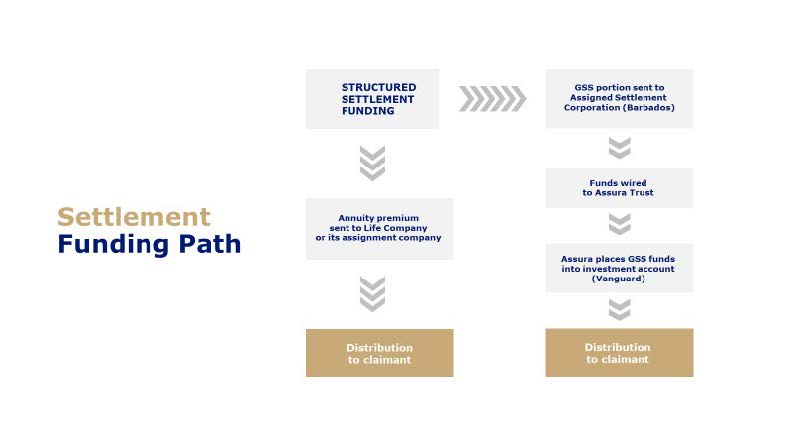

See the flow chart below to see how the money flows when a Growth Structured Settlement is created.

Assura Trust has was developed with considerable support of property and casualty insurance companies and does not necessarily require a QSF to implement.

We welcome the opportunity to tell you more about GSS. Give us a call at 888-325-8640 to answer any questions or to learn more about how these market-based structured settlements work. Let's have an educational meeting in person or on Zoom to show you, your firm or your colleagues the details.

New Spanish version of the Assura Trust brochure is available.

Please ask us.

#growthstructuredsettlement, #assuratrust #marketbasedstructuredsettlement #blendedstructuredsettlement #whataremarketbaseddstructuredsettlements, #GSS

Last updated April 22, 2024