Medicare Set Aside Administration

Should You Self Administer MSA or Use Professional MSA Administration?

- Small amount of MSA

- Perception that professional administration is costly

- Lack of awareness of their ongoing responsibilities

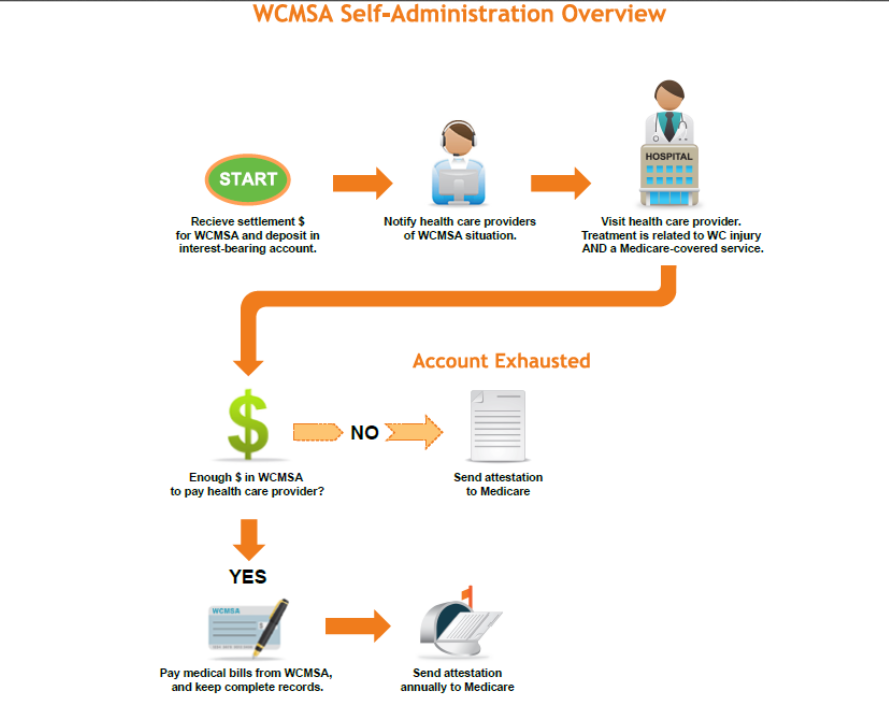

*Someone at CMS forgot the " I before e, except after c" rule in the above chart!