Are Structured Settlement Payments Considered Income?

How to Avoid a "Knuckles Sandwich"

Are Structured Settlement Payments Income?

Whether you must include the settlement proceeds in your income depends on all the facts and circumstances in your case. See IRS Publication 4545 (irs.gov).

Structured settlement payments are income , however structured settlement payments are tax exempt income, if they represent payment of damages for personal physical injury, physical sickness, wrongful death or workers' compensation, and wrongful imprisonment [ see Internal Revenue Code of 1986, as Amended Sections 104(a)(1), 104(a)(2), 139F and 130].

Here's what the IRS says:

"If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non- taxable . Do not include the settlement proceeds in your income".

Source: IRS Ibid.

When Are Structured Settlement Payments Taxable Income?

Where structured settlements are used to pay for taxable damages, using a non-qualified assignment or for structured attorney fees, payments are generally considered income and reportable in the year received.

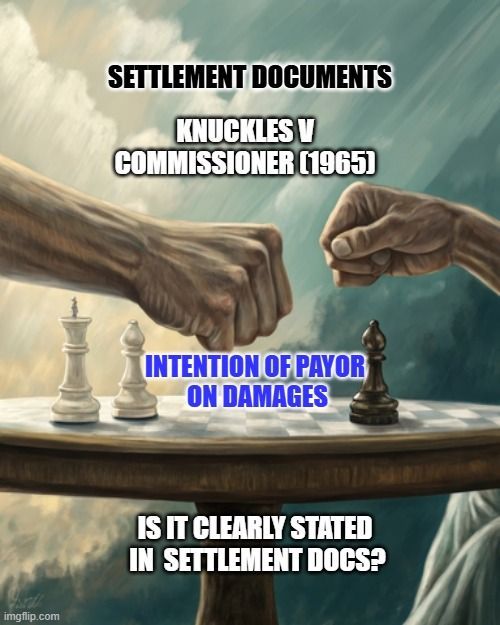

What is a "Knuckles Sandwich"?

The IRS states in Publication 4345 that "a settlement payment may consist of multiple elements that have been allocated by the parties. For example, an agreement may include allocations to back pay, emotional distress, and attorneys’ fees. Generally, the IRS will not disturb an allocation if it is consistent with the substance of the settled claims".

The seminal oft cited case is Mason K. Knuckles and Bernice A. Knuckles, Petitioners, v. Commissioner of Internal Revenue, Respondent, 349 F.2d 610 (10th Cir. 1965), which was decided unfavorably for the taxpayer because the settlement agreement between the parties did not support the taxpayers' allocation for a personal injury.

"The most important fact in making that determination, in the absence of an express personal injury settlement agreement, is the intent of the payor as to the purpose in making the payment. Agar v. C. I. R., 2d Cir., 290 F.2d 283. In this connection, the evidence shows that Perpetual did not, at any time, acknowledge any possible liability for personal injuries to Knuckles and in fact consistently denied any such liability. No proof was ever presented to Perpetual of the existence of any personal injuries from which it could evaluate a proper settlement. The Tax Court expressly found that the settlement payment was made by Perpetual because "the board felt settlement with petitioner had to be effectuated because the publicity incident to a trial of petitioner's claims would * * * endanger the continued existence of Perpetual." This important finding has full support in the testimony of the attorney for Perpetual as well as in the minutes of Perpetual's board of directors".

Always speak to your CPA about your personal tax situation.

Last updated August 16, 2025