Exit Strategy for Business and Home Owners with Capital Gains

STRUCTURED INSTALLMENT SALES

Defer Taxes, Customized Cash Flows in 2026 with a viable 1031 Alternative

STRUCTURED INSTALLMENT SALES 2026

How Structured Sales Work |We Know Structured Sales®

Structured Installment Sales Defer Capital Gains with Customized Structured Sales Cash Flow, the Safe and Secure Way

4structures.com LLC works with buyers and sellers of highly appreciated real estate and eligible owners of highly appreciated business interests, real estate lawyers, real estate agents, real estate brokers and business brokers to facilitate structured installment sale transactions as part of several real estate and business exit strategy solutions the company offers. Bring your capital gains challenges!

I. What is an Installment Sale?

An Installment Sale offers an opportunity for an eligible Seller to defer recognition of some or all of the gain on a disposition of qualified property. The Seller must be eligible to report the sale of property or business pursuant to IRC §453. The qualified property, subject to the installment sale could be piece of highly appreciated real estate or property, or an interest in a business or professional practice. For a sale to constitute an Installment Sale, it must be a sale of qualified property where the Seller receives at least one payment after the tax year of the sale.(1)(2) #installment sale

Each installment payment received by the Seller consists of the following three components: (a) nontaxable recovery of the investment (b) taxable gain, and (c) interest .(3)

The Structured Installment Sale provides guaranteed income for qualifying property or business sales that are eligible for the installment method under Internal Revenue Code §453

II. How a Structured Installment Sale Works

A traditional installment sale arrangement has the Seller dependent upon the financial solvency of the Buyer for future periodic payments that the Buyer owes to the Seller. Since the Installment Sale permits the Seller to take payment in the form of a periodic payment, the Seller could potentially be at risk if the creditworthiness of the Buyer is suspect at the outset, or later deteriorates. To mitigate this credit/default risk, the Seller and Buyer can instead agree to consummate a "Structured Installment Sale". A structured installment sale is also known as a structured sale.

Is a Structured Installment Sale an annuity?

No, a structured installment sale is not an annuity in the same way a structured settlement is not an annuity. Both instances involve an agreement or promise to make future periodic payments as consideration for a settlement of claims or disputes, or for the transfer of personal or commerical real estate or a business interest (structured installment sale) . An annuity is the most common financial product used to fund a structured installment sale.

III. 4structures.com LLC Has a Variety of Structured Installment Sales Solutions

to Meet Clients' Property or Business Exit Strategies

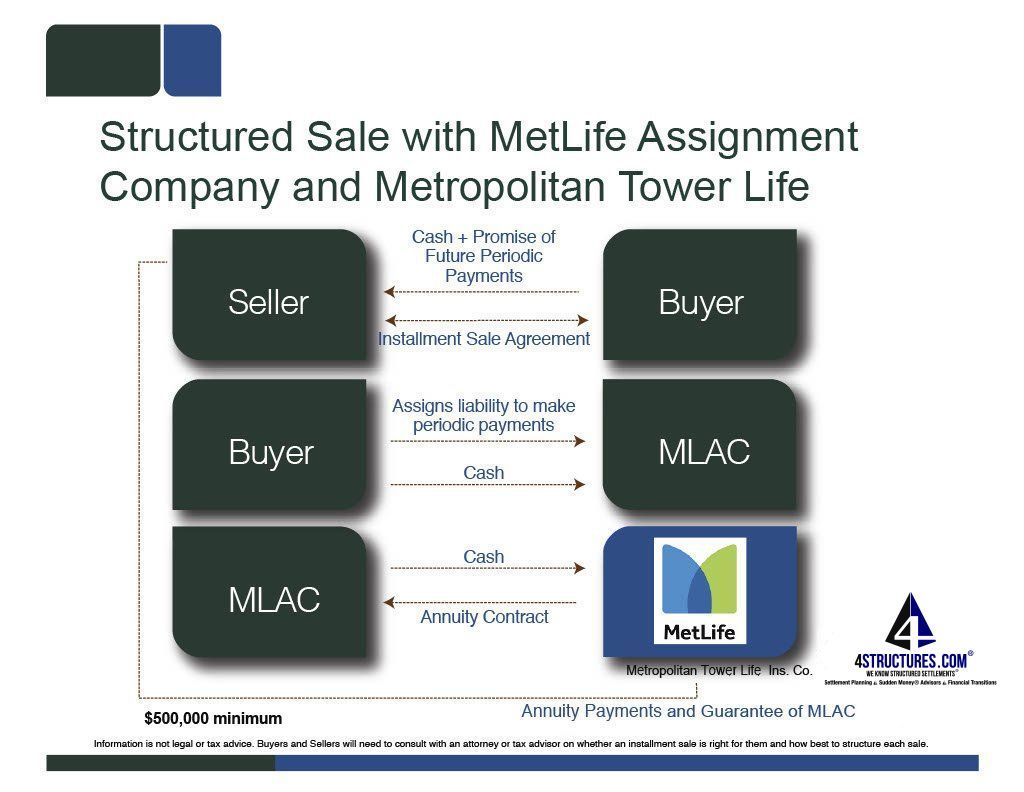

Annuity Backed Structured Installment Sales

1. Metropolitan Tower Life Insurance Company ("Metropolitan Tower Life" or "MetLife") offers a fully domestic structured sales solution through select brokers and agents, including John Darer of 4structures.com LLC. The Metropolitan Tower Life product allows for business and real estate sales to be paid out in periodic payments, the obligation for which will be transferred, by the buyer, to MetLife Assignment Company, Inc. (MACI), which is domiciled in Delaware. MetLife Assignment Company will in turn purchase an annuity from Metropolitan Tower Life Insurance Company to fund the future obligation to the seller. Metropolitan Tower Life also guarantees the performance of MACI. Metropolitan Tower Life Tower Structured Installment Sale solution is now available in all 50 states!

ALERT to New York Real Estate brokers and firms and owners with low basis high value real estate

- New York Structured installment sales are now available as a tool to help create opportunities to help move property where sellers might benefit from a spread out of capital gains that qualify for installment sale treatment under IRC 453.

- Buyers can make more creative offers that help the seller and may enable them to negotiate improved terms.

Applications for use include (1) Real Estate Sales or Personal Property (e.g. a home) (2) Commercial Property (e.g. an office or apartment building, a retail store, gas stations, farmlands, etc.) (3) Sale of a business or practice (e.g. CPA/accounting, dental, medical or veterinary practice). Please note that Metropolitan Tower Life has a $500,000 minimum. Payments must begin by the 13th month to comply with IRC 72(u). Maximum payout duration is 40 years of future payments. Payments can be structured with a fixed COLA of up to 3%. Scroll down to see Met Life structured installment sale flow chart and read John Darer's blog on MetLife Structured Installment Sales.

Read How MetLife Structured Installment Sales Compare with Alternative Solutions

View MetLife Structured Installment Sales brochure now!

Call to Discuss Structured Installment Sales now!

2. Independent Life Insurance Company has two annuity backed structured sale solutions.

Independent Life product will allow for business and real estate sales to be paid out in periodic payments, the first position obligation for which will be transferred by the buyer, to Structured Assignments, SCC (domiciled in Barbados). The chosen Assignment company will in turn purchase a fixed annuity from Independent Life Insurance Company to fund the future obligation to the seller. Can do immediate and deferred start dates of beyond one year. Indepndent Life Insurance Company does not do business in New York.

Independent Life has an alternative structured installment sale funding solution for those with an intermediate or long-term horizon, where the first position obligation is transferred by the buyer to Dominion Assignment Company (Switzerland) SPC Limited, registered in the Cayman Islands, which is managed and controlled in Switzerland by Dominion Fiduciary Services (Switzerland) SA, a licensed and regulated Swiss trust company ("Dominion Trust") in accordance with the US-Switzerland tax treaty. The Dominion Group is one of the leading providers of innovative and compliant solutions in Private Wealth, Pensions and Trust & Corporate services from within Europe, the United States of America, and the United Kingdom. The obligation transferred to Dominion Assignment Company is funded by an uncapped iStructure fixed index structured annuity issued by Independent Life Insurance Company that has payment adjustments tied to changes in the Franklin BoFA World Index.

- Read more about Uncapped Fixed Index Structured Settlement Annuity | IStructure.

- Read the Independent Life White Paper about funding a Structured Installment Sale with iStructure

- FAQ Concerning Structured Installment Sales funded by iStructure Indexed Annuity issued by Independent Life

3. American Equity Life Insurance Company

Their SPIA is another annuity backed structured installment sale option, when using Structured Assignments, SCC as the non-qualified assignment company.

4. Havelet is an independent assignment company with another structured installment sale method. With Havelet, the installment periodic payment obligation is assigned by the buyer, to Havelet Assignment Company, a non-qualified assignment company domiciled in Barbados, with the fixed option backed by a private placement annuity and another market-based option with an annuity wrapper. Can do immediate start date as well as deferred start dates of beyond one year.

Why Do Some of These Options Involve an Independent Assignment Company

located in Barbados? Check out this video

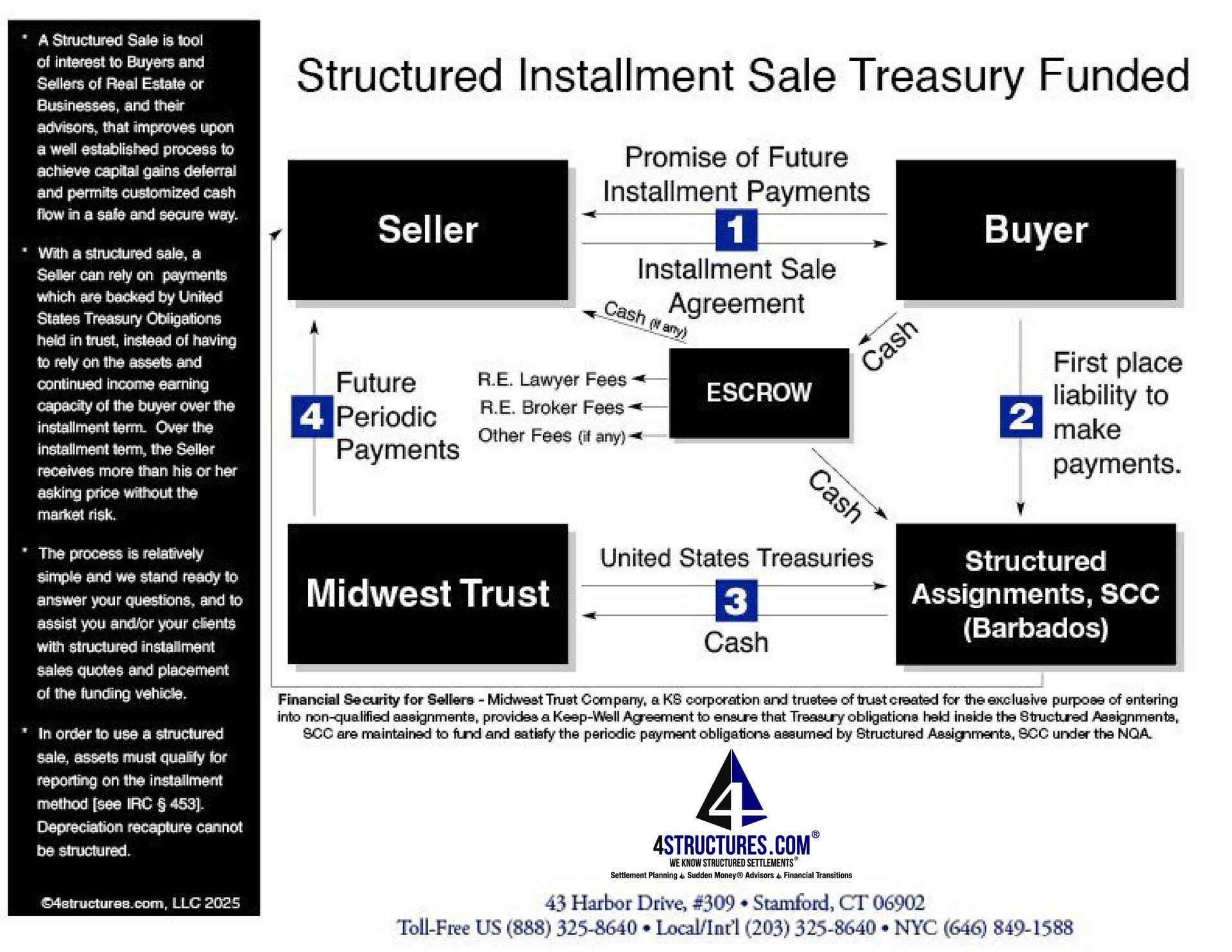

Treasury Funded Structured Sales

With one structured sale method, the installment sale agreement provides that the installment periodic payment obligation will be transferred, by way of non-qualified assignment to Structured Assignments, SCC, a third-party special purpose non-qualified assignment company and, will be funded by the purchase of United States Treasuries held in trust. The Assignee has established an irrevocable trust, with Midwest Trust Company for the purpose of naming a trustee to hold United States Treasuries to better fulfill its obligations to the Seller. Moreover, Midwest Trust Company issues a Keep Well Agreement [download sample]. This may help provide far greater assurance to the Seller that he or she will receive the future periodic payments when scheduled and achieve the intended tax deferral. Need a visual? Simply scroll down to see

Structured Installment Sales Flow Chart below.

Need more info about structured installment sales?

Please call 888-325-8640

III. Why Installment Sales?

- Defer recognition of some or all of the gain and generate a long-term cash flow plan so that your tax hit is spread over many years and is integrated into your business, financial or estate plan.

- Guaranteed rate of return

- Funds that would be lost to taxation (if taken in a lump sum) are put to work for tax deferred growth.

IV. Why Structured Installment Sales?

- A structured installment sale saves you money on your taxes by structuring payouts as installments. This lowers the capital gains tax by deferring the realization of those gains over a period of several years, instead of in a single tax year. With an inverted yield curve and even short rates are competitive

- Better than stand by letter of credit, the "cash windfall" from which, if exercised, would provide security but would not help seller maintain their strategy to defer capital gains.

- For the conservative, we offer annuity backed structured sales, in which the Seller can rely on a payment promise that is backed by an annuity from an NAIC 1 rated, regulated life insurance company, or Treasury Funded Structurerd Sales, backed by United States government obligations held in an irrevocable trust Other options available depending on risk tolerance.

- Concerns over investment risk for either party or no need to take risk.

- Long term financial security for seller. Seller is seeking stable income with guarantees.

- Another tool to assist real estate agents and brokers "over the hurdle" when helping clients close deals involving the sale or purchase of highly appreciated homes, buildings and other real property.

- Another tool to help business brokers and their clients to close deals involving the sale or purchase of highly appreciate businesses.

V. What Types of Asset Sales Do Not Qualify for a Structured Installment Sale?

The following items cannot be disposed of with a structured installment sale

- Disposition of inventory

- Disposition of depreciable property to related persons (defined at IRC §267(b) where the related person disposes of the property within 2 years

- Sales resulting in a loss

- Dealer disposition of real and personal property, with certain exceptions as provided in IRC §453

- Disposition of stock and securities traded on an established market

- The portion of the gain attributable to depreciation recapture taken on real or personal property. Depreciation recapture represents amounts previously deducted for depreciation Source: IRS Publication 537

VI. Are you a Structured Sale Candidate or

Do You Represent a Candidate for a Structured Installment Sale?

- Are you an owner of highly appreciated real estate or property?

- Are you the owner of highly appreciate commercial property?

- Are you the owner of an existing agricultural business? A structured installment sale can be used to convert an existing agricultural business into a new type of venture. Individuals and businesses whose activities fall under the definition of farming outlined under IRC 2032A (e)(4) & (5)

- Are you a real estate agent or real estate broker representing an owner with highly appreciated real property who would like to sell but has a big capital gains problem?

- Are you a buyer or real estate agent or broker representing a buyer who wants to buy a property whose owner has a big capital gains problem, and it has been an obstacle to the sale of the real estate?

- Are you an owner or partner in a business which you started with a modest amount of money, that is worth a lot more now, and you would like to sell your business interest, to an associate or to an outside buyer, yet are afraid of getting killed by capital gains taxes?

- Are you an owner or partner in a business, which you started with a modest amount of money, that you (and/or others) built up with your sweat and business acumen, like a medical or dental practice, that is worth a lot more now and you (and/or others) would like to get out, but you want an exit strategy that allays fears of selling your business, having a buyer default leaving you (and/or others) with the potential of unexpectedly having to again run a business that may have lost goodwill or been mismanaged. When you retire from or sell your business you want finality.

- Are you a business broker, financial advisor, lawyer or CPA who has a client with a highly appreciated business?

- Are you selling a piece of highly appreciated property or a business interest and, do you have little immediate large cash needs and have the thought that being able to safely and securely deferring capital gains into the future (when you want it) is appealing?

Answering "Yes" to any of the above questions means you (or your client) could benefit from a Structured installment Sale. Please contact John Darer at 4structures to discuss your specific needs. We Know Structured Sales®

Are there any restrictions on Structured Installment Sales?

- No life only payment streams. Must be periodic certain or certain and life

- Periodic payments may not be secured or pledged

- Periodic Payments assumed by the Non Qualified Assignment company must not be changed from the periodic payments owned by the Buyer prior to the Assignment. The periodic payments are non-transferable and non-commutable.

- The Seller cannot assign the installment sale payment stream to a factoring company, such as JG Wentworth.

- The Seller's estate must be beneficiary.

Helpful Structured Installment Sale Resources

- IRS Publication 537 (2016) on Installment Sales

- Topic no. 705, Installment Sales| Internal Revenue Service

- 2025 Capital Gains Tax Calculator -Long-Term & Short-Term Gains Calculator | Smart Asset

- Breathing Life Into Installment Sales by San Francisco Tax attorney Robert W. Wood, Esq.

- IRS Form 6252 Reporting Installment Sale Income

- Revenue Ruling 82-122 Disposition of an Installment Sale Obligation When There is a Substitution of Obligor

- IRS Private Letter Ruling 111550-12 Substitution of Obligor of Existing Installment Sales Agreement is not Disposition or Satisfaction for purposes of the installment sales provisions under § 453B. Moreover, where the original installment note is replaced, the substitution of a new promissory note without any other changes is not a disposition of the original installment note under § 453B.

- US-Switzerland Tax Treaty Documents from IRS.gov [for those considering iStructure]

Footnotes

- Real or personal property sold by a dealer or a person who regularly sells property on the installment plan and property included in inventory do not qualify for the installment sale rules. Marketable securities are not eligible for installment sale treatment. Other restrictions apply.

- Please consult your tax advisor before entering into an installment sale agreement. Special rules apply to non-dealers. Please consult with your tax advisor to determine whether those rules could impact your arrangement.

- Please note that information provided on this page is not intended as legal or tax advice. Please consult with your attorney or tax advisor on whether or not an installment sale is right for you, and how to best structure such sale

#defertaxonsaleofproperty #defertaxonsaleofbusiness #defertaxonsaleofmedicalpractice #structuredsales #NJstructuredsales #CAstructuredsales #FLstructuredsales #structuredinstallmentsales #CTstructuredsales #RIstructuredsales, #newscanaanstructuredsales #structuredsalehowitworks #CTinstallmentsales #NYinstallmentsales #NYCinstallmentsales #californiainstallmentsales #NJinstallmentsales, #RIstructuredinstallmentsales, #IRC2032A #Naplesstructuredsales #westchesterrealestatesales #fairfieldcountyrealestatesales #greenwichrealestatesales #stamfordrealestatesales #sellingabusiness #siliconvalleyrealestatesales #businessbroker #recaptureddepreciation #saleofabusiness #saleofrealestate #PalmBeachstructuredsales #hamptons

Last updated January 13, 2026

Structured Installment Sales

Have a question? I'm here to help buyers and sellers of real estate or businesses, real estate professionals, real estate lawyers, business brokers and tax professionals. Call me at 888-325-8640 or send me a message and we’ll get be in touch.