iStructure | Uncapped Fixed Index Structured Settlement Annuity

Game Changing Innovation from Independent Life

iStructure is an innovative game changing structured fixed index annuity for plaintiffs or attorneys

- with an intermediate to long term horizon,

- who like the idea of a structured settlement and having a stream of income,

- seek the potential for something more than current fixed rates.

iStructure Classic was the structured settlement industry’s first “uncapped” fixed index linked structured settlement annuity

While having structured settlement payment adjustments tied to changes in a published index is not without precedent, . With iStructure you don’t have to wait until payments start before structured settlement payments start to participate in the changes in the index. iStructure is an insurance product issued by Independent Life Insurance Company, out of Dallas, Texas, the first life insurance company solely focused on the structured settlement market.

iStructure can be used for personal injury settlements, structured attorney fees, structured installment sales and taxable settlements. wrongful incarceration, for clients who seek a settlement option with tax-free or tax-efficient income (depending on type of damages that payments represent), the potential for increasing income, customizable payment options, downside protection, and inflation protection.

Key Talking Points about iStructure

- With iStructure Select, introduced in June 2025, payees can participate in market-driven growth by linking their structured settlements to leading financial indexes, including the S&P 500®, Nasdaq-100 Volatility Control 12%™ Index, and Franklin BofA World Index™. You have an opportunity to enjoy a higher payout than you would with a traditional structured settlement annuity, or competing products, while still having a floor of protection. The product can be used as a stand alone or in conjunction with a traditional structured settlement product.

- You set the timing and pattern of payments. The amount of each payment depends on how much you allocate initially and how each payment grows over time.

- Once a future payment grows, it will never decrease.

- Like traditional assigned settlement funding assets, iStructure payments can be customized to meet client needs with expected payments based on a client defined growth rate that can simulate any desired payment pattern.

- Like traditional assigned settlement funding assets, iStructure payments must be set as to timing and once established, cannot be accelerated, deferred or modified, except that the payment amount changes with the index performance. The underlying form is that of an immediate annuity.

- With iStructure, guaranteed payments grow linked to the chosen index. You can find out more about the index by visiting its website at The ideal prospects for iStructure seek higher payments than with a traditional product as an allocation in their settlement plan.

- The growth is tied to the chosen index from those available for selection and the Participation Rate of your annuity.

What is a volatility-controlled, excess return index?

A volatility-controlled index shifts assets between a risk component and a risk-free component to reach the targeted volatility level. In plain words, the insurer can give you a higher Participation Rate and, over the long term, pass more value to you than could be done with more familiar, but also more volatile, equity market indexes. .

Comparing Crediting Rates of iStructure vs Traditional Structured Annuity

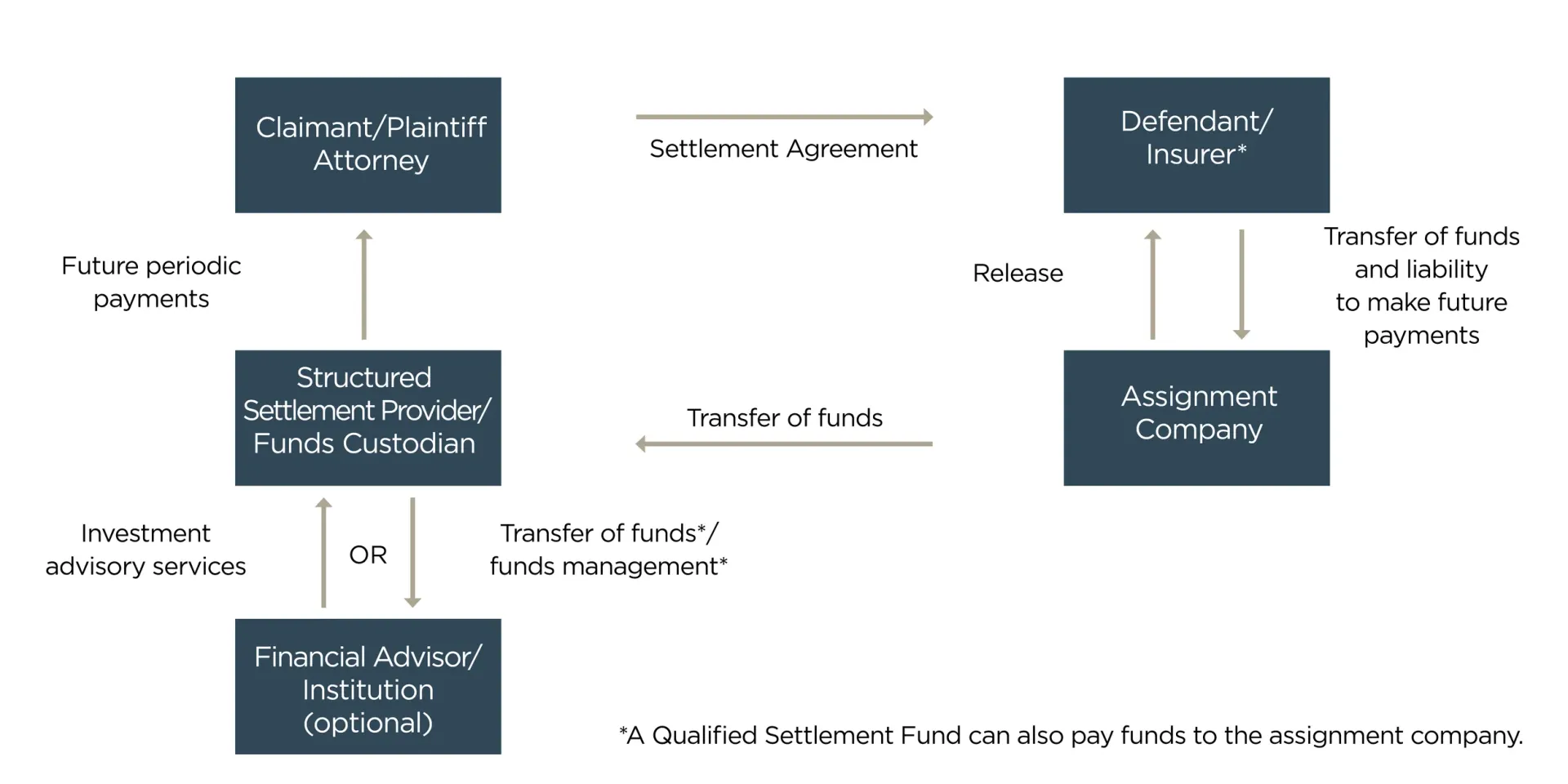

- With a traditional product, the assignment company and the life insurer take money from the total structure consideration to pay acquisition costs and distribution costs, then return the balance with interest at a fixed rate to provide fully guaranteed benefits, which in all but the shortest duration cases exceed the cost of the structure.

- With iStructure, the assignment company and the life insurer take money from the total structure consideration to pay acquisition costs and distribution costs, then return the balance (the initial guaranteed amount) with nonguaranteed gains from the index performance to provide benefits, the amount of which depends on the year-by-year index performance.

- It’s important to know that while it is expected to provide more money than the traditional product, perhaps even a lot more, with iStructure, the life insurer does not guarantee any positive gain. It is conceivable that the amount returned would be less than the total settlement consideration. However, even in the worst case where there is no growth from the index ever, Independent Life guarantees to return the initial guaranteed amount. Further, in any year where the index performs favorably, the prior guaranteed future payments will grow, and that sum becomes the new guaranteed future amount.

- The rate of growth is the Participation Rate times the year over year growth rate of the index. The participation rate varies from case to case and can range from 30% for the shortest cases to 100% for long duration case.

- Should the index perform unfavorably, the guaranteed future benefits stay the same, losses are zeroed out and treated as no gain. From year-to-year future guaranteed payments grow or stay the same, they never shrink.

- With iStructure payees can now be provided with the opportunity to achieve higher returns they might obtain from investing in equities while still leaving all the investment risk with the insurer, Independent Life.

How Does Independent Life Hedge The Risk?

Using options on the chosen Index, Independent Life limits its risk and makes it viable to guarantee a participation rate. By accepting a lower guaranteed payout, clients can have the opportunity to receive a materially higher expected payout while securing a guarantee from Independent Life and leaving all the credit investment risk with the insurer.

- Independent’s source of profit is about the same. With iStructure they seek to earn more in investment returns than they spend on options;

- With traditional fixed structures insurers hope to earn more in investment returns than they spend on required interest to provide structured settlement benefits.

- Using the iStructure Classic example, the Franklin Templeton and Bank of America are providing the index, and Bank of America Securities is independent’s source of options to replicate the index performance, neither Franklin Templeton, Bank of America, nor any other party helping Independent to deliver this product is in any way responsible for the design, sale or administration of the iStructure Indexed Annuity or the paying of any benefits from the annuity. Those responsibilities rest solely and completely with Independent Life.

Independent Life Receives IRS Private Letter Ruling

- Independent Life sought and received IRS Private Letter Ruling 202436007 that iStructure meets the conditions to be a Qualified Funding Asset per IRC Section 130(d).

- Periodic payment obligations for qualified assignments will be transferred to Independent Assignment Company in Dallas TX. Non-qualified assignments that are ultimately funded with iStructure, will be transferred to United Assignments, SCC, registered, managed and controlled in Barbados.

- Non-qualified cases such as employment, wrongful incarceration, intellectual property, breach of contract and structured installment sales

- 4structures has domestic assignment and offshore assignment solutions for its clients. Read more about non qualified assignments.

Independent Life Payee Protection Policy

All Independent Life structured settlement annuities are subject to its Structured Settlement Payee Protection Policy. When notified of a proposed structured settlement transfer, Independent Life will review the terms of the proposed transfer and will object to those transfers where:

- The discount rate used exceeds the Federal Reserve’s Bank Prime Loan Rate plus 5.0%;

- Independent Life has a record of diminished capacity, a traumatic brain injury (TBI) or other cognitive impairments, and Independent Professional Advice (IPA) has not been provided.

- The payee is under the age of 25, and Independent Professional Advice (IPA) has not been provided; and/or

- The jurisdiction of the proposed 5891 transfer does not correspond with the address of the payee (proposed transferor) on file with Independent Life

- At least annually, Independent Life will publish a report outlining the number of structured settlement transfer petitions, orders approving and denying such transfer petitions, and appeals affecting Independent Life structured settlement annuity contracts.

- Independent Life will reserve the right to appeal any structured settlement transfer order that has been granted over its objection

iStructure is not available on New York settlements

Who is Independent Life insurance Company?

Founded in 2018 by insurance industry experts, Independent Group is a forward-thinking enterprise whose complementary product and service companies improve outcomes for all structured settlement stakeholders. Independent Life, its underwriting division, is dedicated to providing structured settlement solutions, including annuities, to serve the needs of injured parties, their families and advocates. With its unique profile and ambitious vision for the structured settlement industry, Independent Life has attracted world-class partners suchas LKCM Headwater Investments, KKR's Kilter Finance and Hannover Re USA which support Independent Life's growth and guarantees.

#indexstructuredsettlementannuity #istructure #independentlifestructuredsettlment #uncappedindexannuity

iStructure logo is a service mark of Independent Life and is used with permission.

Last updated October 27, 2025