MetLife Structured Installment Sale

Structured Installment Sale

What is a Structured Installment Sale ?

Strucured Installment Sales are designed for buyers in property and business sales to transfer periodic payment obligations to an assignment company where the seller will receive at least one payment after the tax year in which the sale occurs. With this method, sellers can potentially see savings in capital gains, net investment income and state income taxes. New York imposes state capital gains taxes, treated as ordinary income, with rates up to 10.9% for high earners. A New York structured installment sale can help defer these taxes, but sellers must plan carefully to avoid triggering higher brackets.

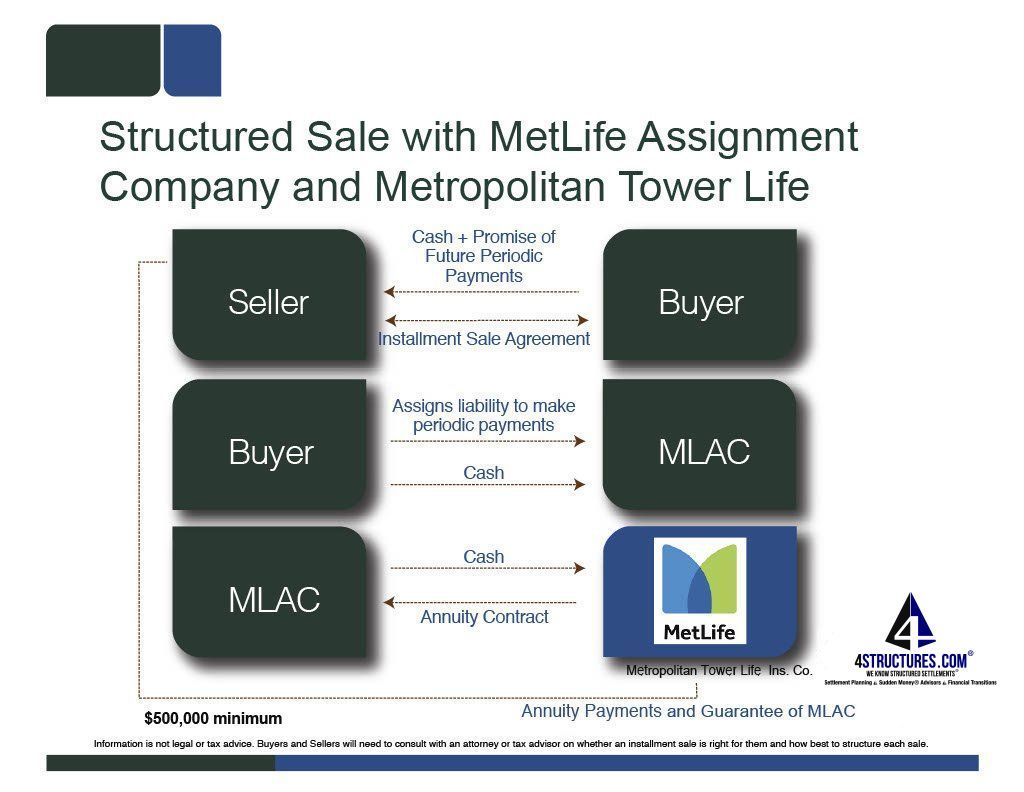

A structured installment sale is a more secure installment sale. The structured installment sale product will allow for business and real estate sales to be paid out in periodic payments, the obligation to pay for which will be transferred to MetLife Assignment Company,Inc., domiciled in Delaware. MetLife Assignment Company will, in turn, purchase an annuity from Metropolitan Tower Life Insurance Company to fund the future periodic payment obligation. See the Met Life Structured Installment Sale Diagram below for the sequencing of the transaction.

Structured installment sales depend on compliance with IRC 453. Not all aspects of a real estate sale can be deferred using the installment method. For example depreciation recapture is something that does not qualify.

Read more about

Structured Installment sales on 4structures.com LLC's dedicated structured sale page.

Owners of Highly Appreciated Real Estate Can Benefit from a Structured Sale

Owners of highly appreciated commercial or residential real estate located in all states but New York may be able to sell their properties and defer capital gains taxes into future years using this completely onshore structured installment sales program introduced by Metropolitan Tower Life Insurance Company.

Location of the Property is the Key

So if the owner moved to Connecticut or New York and sells property in NJ, the owner is eligible to use the MetLife solution. There is a minimum case size of $500,000. John Darer is available to work with real estate agents whose clients have highly appreciated, low basis real estate and/or business interests, property owners, buyers and legal and accounting professionals throughout the USA in the 45 states where he holds insurance licenses such as New York, Connecticut, New Jersey, Texas, California. Colorado, Connecticut, Louisiana, Florida, Rhode Island, Maryland, Massachusetts, Virginia, Alaska, Hawaii and others.

Owners with interest in a Professional Practice or Business that has High;lu Appreciated in Value, can also Benefit from a Structured Installment Sale Deferral Program

Whether you have an interest in a dental practice, a medical group, a law firm partnership or other business interest, your life's work can be concerted to an income stream that is not dependent on the financial viability of the practice or business after you leave.

MetLife Structured Installment Sale

is a Completely Onshore Solution

Unlike some of the other alternatives, MetLife's assignee, MetLife Assignment Company, Inc. and the annuity issuer/guarantor of the assignee, Metropolitan Tower Life Insurance Company, are domiciled in the United States of America. There are other structured installment sales solutions that involve some aspect of the transaction being offshore to avoid double taxation. In order to do this, the structured installment sale periodic payments must be substantially equal and must be substantially equal and must begin by the 13th month. Payments can be stretched out as long as 40 years under MetLife's structured installment Sale program.

This product will allow for business and real estate sales to be paid out in periodic payments, which will be transferred to MetLife Assignment Company,Inc., domiciled in Delaware. MetLife Assignment Company will in turn purchase an annuity from Metropolitan Tower Life Insurance Company to fund the future obligation to the Seller..

With the July 2025 roll out of MetLife's structured installment sale program in New York, eligible transactions in New York City, Long Island, Westchester and beyond include:

- Real Estate Sales

- Personal Property (e.g. a home)

- Commercial Property (e.g. an office or apartment building, a retail store, farm lands, etc.)

- Sale of a business or practice (e.g. medical, dental or veterinary practice)

Important Pricing Guidelines for MetLife funded structured installment sales

- The Periodic Payments Must:

- Begin Immediately

- Be substantially equal

- Payout in regularly scheduled intervals

- Payout no less frequently than annually

- No Lump Sums Permitted

No Lifetime payments

Attention Real Estate Brokers, Business Brokers

Contact John Darer Now at 4structures.com LLC to learn how to integrate this concept into your practice.

Click tocall John Darer Now

Schedule time John Darer Calendly

Last updated July 8, 2025