USAA Life Now Offers COLA on Structured Settlements

Frame Your Financial House for Long Term Stability

USAA Life Insurance Company, based in San Antonio, Texas, and a provider of structured settlement annuities, announced in July 2025 that it would start quoting and issuing structured settlement annuities with fixed cost-of-living adjustments as a settlement planning option. The adjustments must be in whole integers, such as 1%, 2%, 3%, and so on.

USAA Life Insurance Company has traditionally had an appetite for long-term lifetime payment streams and remains highly competitive for annuitants up to age 30. The recent improvement in payment options is a welcome change.

USAA Life Insurance Company Financial Ratings are a Strength for those seeking a Long Term Payment Stream or Long Dated Deferred Lump Sums

- A.M. Best A++

- Moody’s Aa1

- S&P AA

- Weiss B+

Ratings Current as of July 16, 2025

How Does a Structured Settlement Work when a USAA Life Insurance Company Structured Settlement Annuity is the Qualified Funding Asset?

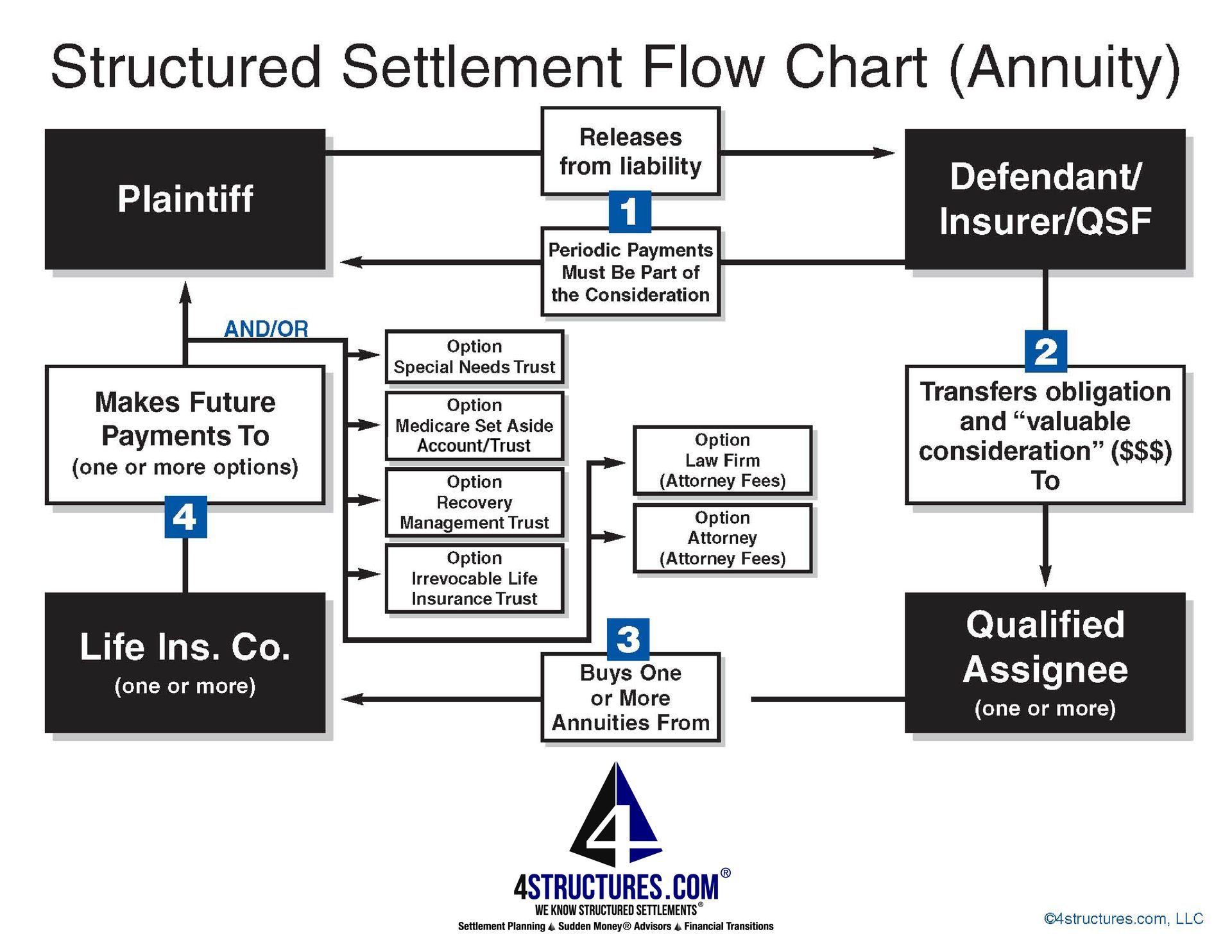

1. Parties enter into a Settlement Agreement and Release which part of the consideration includes an obligation to make futire periodic payments to the Plaintiff. [Step One in Flow Chart below]

2. Pursuant to the terms of the Settlement Agreement and IRC 130(c), the obligation to make future periodic payments to Plaintiff is then assigned by way of a Qualified Assignment to the Qualified Assignment Company and an Assignment Payment is made by the Defendant or its Insurer to the Qualified Assignment Company, USAA Annuity Services Corporation. [Step Two in Flow Chart]

3. Pursuant to the terms of the Settlement Agreement and Release, and the Qualified Assignment Agreement, the Qualified Assignment Company, USAA Annuity Services Corporation, purchases a Qualified Funding Asset, in the form of an annuity from USAA LIfe Insurance Company to fund the periodic payment obligation it assumes.