Structured Settlement Beneficiary | Why It's Important

How to Name a Structured Settlement Beneficiary

Why Name a Beneficiary on Your Structured Settlement Annuity?

Avoid probate for the annuity proceeds. Probate is a legal process that takes place after a person dies. Probate involves, among other things:

- proving in court that a deceased person's will is valid (usually a routine matter)

- identifying and inventorying the deceased person's property

- having the property appraised

- paying debts and taxes, and

- distributing the remaining property as the will (or state law, if there's no will) directs. [Source: Nolo.com]

If you do not name a structured settlement beneficiary , the proceeds of your annuity or structured settlement pour into your probate estate. Then they must go through a probate process that could take six months, a year, or even years, depending on where you live. The value of the proceeds going though your estate could be subject to claims of creditors and fees payable to executor/executrix, if you have a will or an administrator/administratrix if you do not have a will.

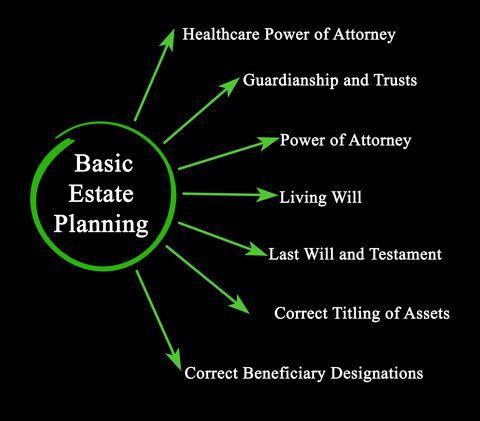

Not naming structured settlement beneficiaries and not having a last will and testament will delay the wrapping up of your affairs after your death.

By naming a beneficiary, your heirs can inherit the in a manner you wish

without having to go through probate.

When Can You Name a Beneficiary of Your Annuity or Structured Settlement?

You can name a beneficiary of your annuity or structured settlement for the balance of annuity value in a deferred annuity remaining on the date of death. For an income annuity, including a structured settlement annuity, the payee may name a beneficiary for any certain payments remaining on the date of their death, unless there is some restriction in the settlement agreement that prohibits changes. Any payments where the payments rights have been previously sold or transferred may not be designated either, subject to the terms of the sale and transfer.

How to Name a Beneficiary for your Annuity or Structured Settlement

Naming a beneficiary of an annuity that you purchase for retirement, or are receiving from a structured settlement, is really easy. In order to name a beneficiary, you must do so in writing. Generally, each insurance company has a beneficiary designation form where you can name beneficiaries. The form must be completed, signed and may need to be notarized. In some cases, it may be possible to change beneficiaries online. [Note: If you have previously sold some of your payments and the remaining payments are subject to a servicing agreement, you may have submitted the request through the servicing company].

A

primary beneficiary

is the first in line to inherit the named benefits.

A contingent beneficiary will only receive the named benefits if the primary beneficiary is deceased.

There can be more than one beneficiary of each type, with percentages to each named beneficiary clearly indicated on the beneficiary designation form.

Some people choose to name a class of beneficiaries, naming a group of people rather than naming them by name

Naming a non-US citizen, or non-resident as a Beneficiary of a Structured Settlement or Annuity

Structured settlement beneficiaries who do not live in the United States and who do not have social security numbers, present challenges to life insurance companies that issue structured settlement annuities. For those with social security numbers, by using the Social Security "Death Master" database, an insurer can easily verify if a beneficiary with a is still living. Then there is the not so small matter of locating the non-US-citizen, non-US resident beneficiary. This can range from challenging to impossible in certain parts of the world.

One carrier has taken the step of requiring that named beneficiaries under such circumstance to acknowledge their status at the time the beneficiary designation is made. It places the burden on the beneficiary to come forward when the annuitant dies.

Last updated July 12, 2024