Using Structured Settlements to Provide a Loving Legacy

Meaning and Money

A Loving Legacy Gift

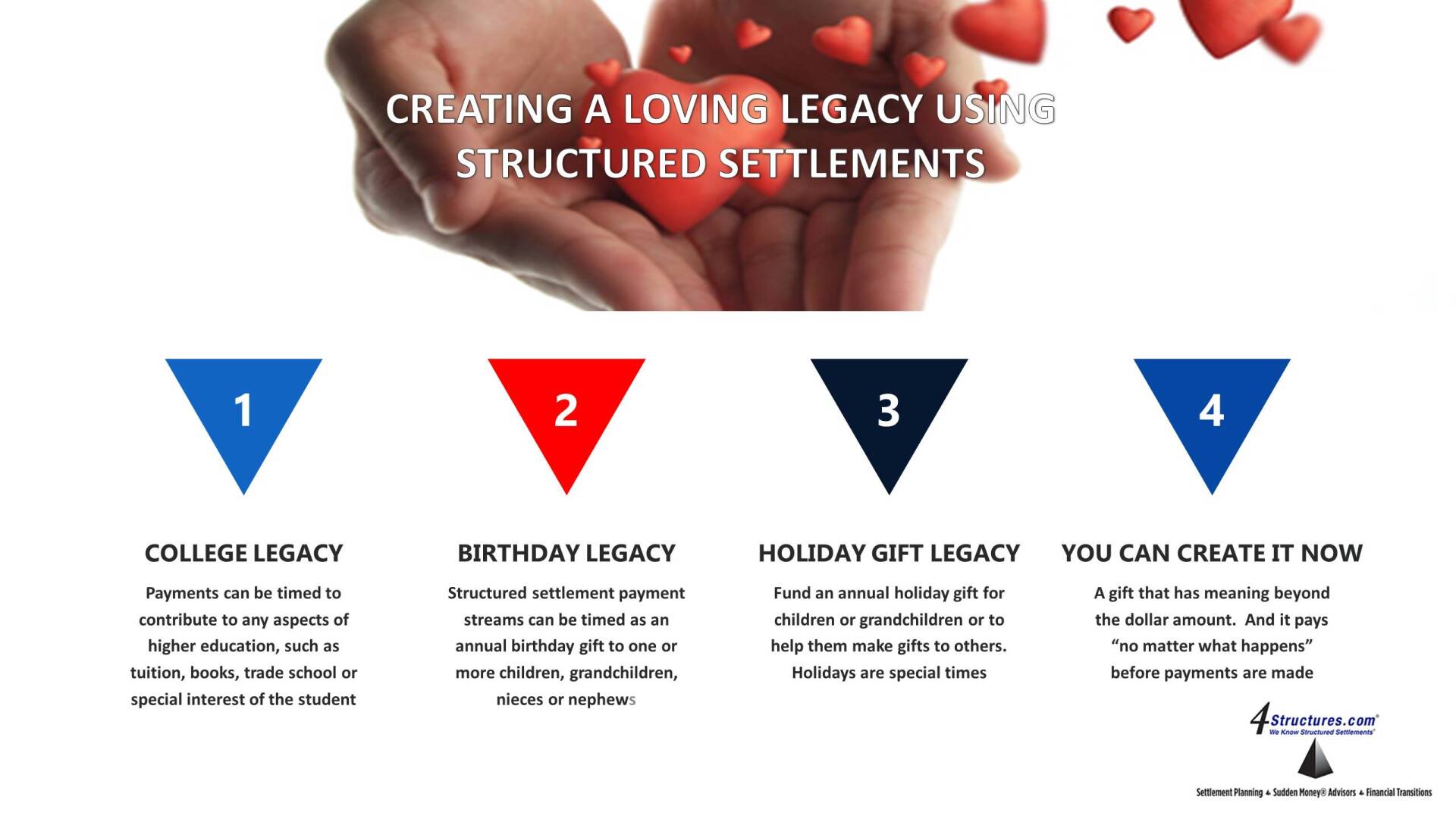

There are many ways that a structured settlement can be used to fund a legacy gift for a predetermined period of time, "no matter what happens...". Here are two examples.

Holiday Gift Legacy

One or more structured settlement payment streams can be used to fund an annual holiday gift fund for your children and/or grand children that will continue as a legacy " no matter what happens...", before all the payments are made. Holidays are special times, but they can also be stressful. A loving legacy gift from a parent or grandparent, or a special uncle or aunt timed to arrive around Thanksgiving every year, is something that (1) has meaning beyond the dollar amount and will long be remembered and (2) it's something you can create now.

Birthday Legacy

A structured settlement payment stream can be timed as an annual birthday gift for your children, grandchildren or a special niece or nephew. A young adult could do the same for his or her parents or siblings.

College Fund Legacy

A structured settlement can be timed to contribute toward any aspect of higher education, such as tuition, books or special interests of the student.

How It Works

The versatility of structured settlements enables you to have more than one payment stream in a single contract. Where the children are not parties to the lawsuit, separate payment streams can be set up in the injured party's name with the intended beneficiary payee listed as the primary beneficiary of a particular payment stream. Some annuity issuers require a separate contract number for administrative purposes, but are accommodating on qualified assignment fees.

Example

As part of her settlement for her medical malpractice case, single mom age 39, with children aged 1, 2 and 7 allocates money to help pay for children's college and annual payments of $1,000 for 21 years to fund a holiday gift fund for each child.

How Does a Loving Legacy Created Via Structured Settlement

Compare With Life Insurance?

Life insurance is an excellent tool for providing for others and it's an area in which we have expertise. However here are some things to consider:

- Getting cost effective life insurance depends on insurability. A loving legacy funded with a structured settlement does not. The question of insurability could arise from the occurrence that gave rise to the lawsuit, or it could be from a multitude of other factors. For example, Covid-19 led a number of life insurers to take a more conservative approach to ratable risks. These include, but not limited to those over age 60 with any of the Covid-19 high risk markers such as obesity, diabetes, heart disease might be postponed or declined.

- With a structured settlement there is no need to draw blood or submit a urine specimen.

- Funding a holiday gift legacy can be done with an allocation from relatively modest settlements. The cost of life insurance may make its use on modest settlements impractical.

Last updated March 20, 2024

#moneyandmeaning #howwouldyouliketobermembered #lovinglegacy