Plaintiffs Take the Initiative in Settlement Planning Engagements

Plaintiffs Take More Authorship Over the Settlement Planning Process

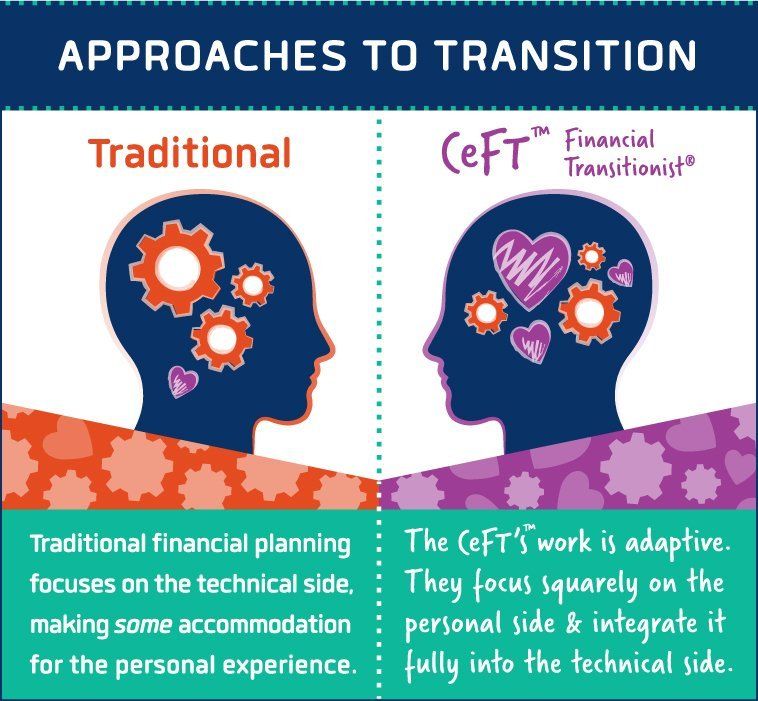

Transition Expertise Matters in Settlement Planning for Plaintiffs in litigation

This is one reason why plaintiffs and claimants are increasingly taking their own initiative to seek out information and to engage and collaborate with settlement advisers of their own choice.

Only two settlement advisers and settlement planners in the industry have been trained, passed a rigorous written and oral examination, and hold the professional designation of

Certified Financial Transitionist (CeFT)

.

The CeFT, conferred by the Financial Transitionist Institute, a division of the Sudden Money Institute, is a step-up designation recognized by FINRA and each designee must comply with ongoing ethical and continuing education requirements to stay fluent with the process and protocols to maintain the designation.

More Plaintiffs Take the Initiative With Increasing Access to Sources of Information

With today's technology, most people know how to surf the internet from desktops, tablets, smartphones or even watches. should not be surprising that injured parties and their families take the initiative to seek out legitimate information and want to speak to knowledgeable, informed experts that they can relate to. They or their guardians can read articles, listen to and watch videos, listen to podcasts at a time that is convenient to them, a time that may be well beyond business hours. Video conferencing services permit virtual face to face meetings and enhanced learning experiences for all without geographic boundaries. Which way do you think the trend is going?

Structured settlement and settlement planning industry advertising/marketing spend is traditionally targeted to plaintiff lawyers not plaintiffs

While some plaintiffs may not see that trial lawyer associations solicit vendors to spend tens of thousands or even hundreds of thousands of dollars to buy access or influence with their membership, some actually do. One noted New York state lawyer wrote on a confidential list serve several years ago that his colleagues should do business with a particular company because they gave $75,000 to the trial lawyer association's Partnership for Justice. A member of that association was so turned off by the notion of "financial incentive due diligence", they supplied us with a copy.

Some settlement companies have advertised/flaunted their contribution, or contribution level on their websites and electronic communications (which in some states, such as New York, is unlawful by the way- See 2007 Opinion of New York Department of Insurance (now Department of Financial Services OGC Op. 07-09-24 2007)

.

"Q. May a life insurance agent or broker that sells structured settlement annuities state in its advertisements that the agent or broker makes or has made donations to a not-for-profit entity, such as an association representing trial lawyers?

A. No. A licensed insurance agent or broker that sells structured settlement annuities may not advertise that the agent or broker makes or has made donations to a not-for-profit organization of concern and interest to potential purchasers of insurance or annuities, such as an association representing trial lawyers, because that would constitute an inducement for the purchase of annuities in violation of Insurance Law § 4224".

Others supplement those large contributions with repetitive tweets and emails to law firms each year to get them to vote for them in "Best of Lists" produced by Law Journals. Increasingly more resourceful plaintiffs see the vendor's activity on social media and wonder about the introduction if their lawyers get too aggressive about it.

The Need for Settlement Planning is Segmented Beyond The Binary

More than twenty-five years ago, a paradigm shift in the settlement industry resulted in a transition from a primarily monosource/monoline to a binary source. But some of the staunchest advocates for the shift may have ignored the logical branch beyond the binary, the plaintiffs themselves. Withih that branch there may be further segmentation.

One of our industry colleagues actually cautioned plaintiff lawyers with the general statement on its website, that "the claimants may hire their own structured broker who will not have your client’s best interests in mind. It’s best to work with someone you (the lawyer) choose so your client isn’t stuck with the defense’s choice". Not only does the statement fail to recognize the new reality, it doesn't make sense. If the claimants do their own research and bring in a qualified, credentialed settlement planner or advisor that the plaintiffs feel comfortable in collaborating with, how is that not in their best interest?

Last updated August 27, 2023

#settlementplanningprocess

#certifiedfinancialtransitionist

#employmentsettlementplanning

#personalinjurysettlementplanning

#settlementadviser

#managingchange

#structuredsettlement

#settlementplanniongsegmentation