Structured Settlement Beneficiary Designations

Follow Up and Always Confirm Beneficiaries With Insurer

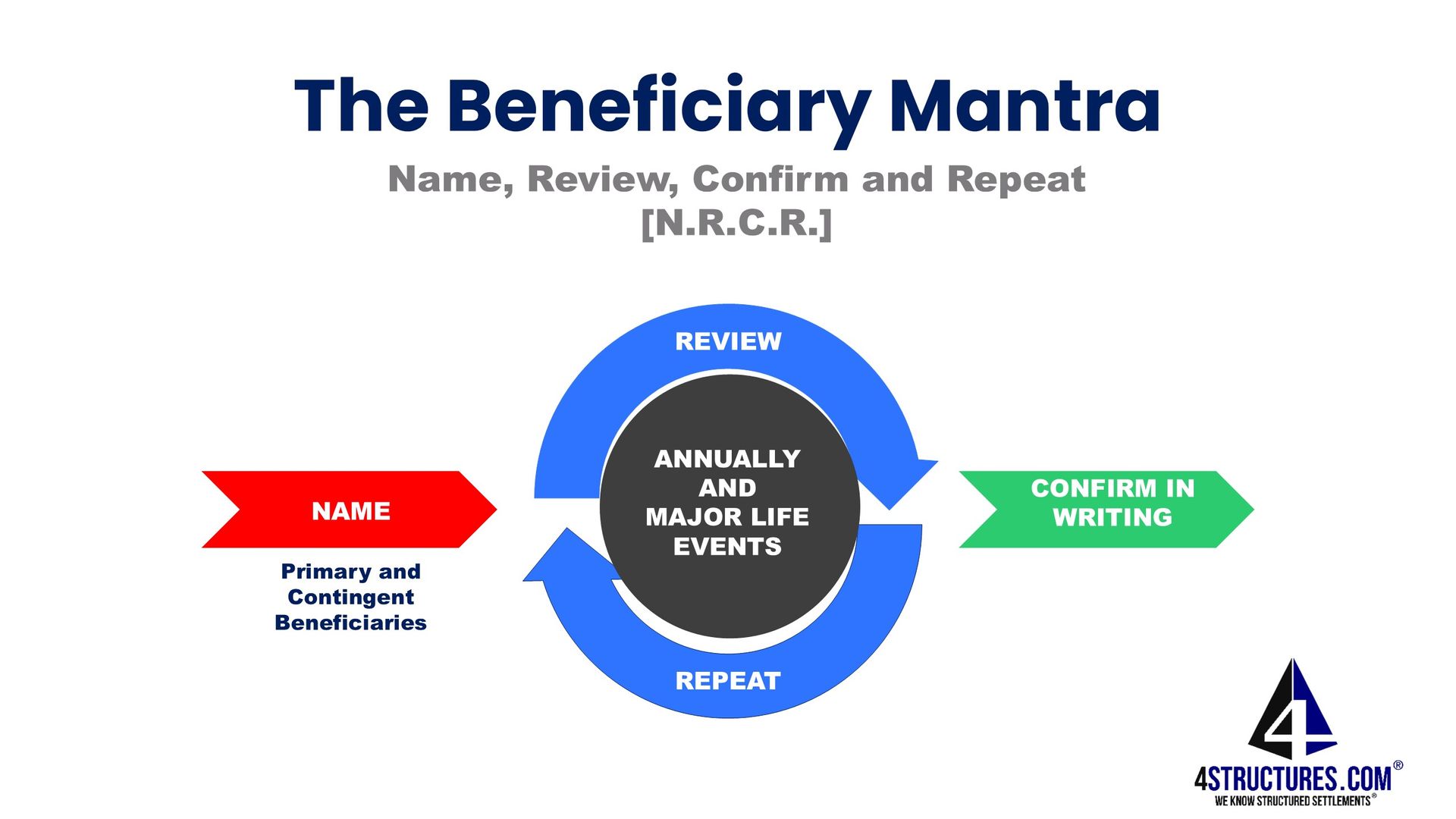

The Beneficiary Mantra is "Name, Review and Confirm (Repeat)"

It's not only important to name a beneficiary of structured settlement payments, annuities, or life insurance, but you should periodically review the beneficiary designation to be sure it reflects your current wishes. If you make a change then you should confirm the change in writing. Always open your insurance company mail! That's because life can change in an instant.

Consider the outcome for John Eutsler's fiancé after he died in an automobile accident November 22, 2019

According to the Order Granting the Defendants' Motions to Dismiss in the matter of TERA VANCE, an individual, Plaintiff, v. BERKSHIRE HATHAWAY LIFE INSURANCE COMPANY OF NEBRASKA; KRISTIN BARNETT, an individual; and BHG STRUCTURED SETTLEMENTS, INC., an unknown entity, and DOES 1 through 50 inclusive, Defendants. United States District Court, S.D. California Case No.: 3:20-cv-01480-BEN-KSC, Plaintiff Tera Vance, the fiancé of a deceased structured settlement annuity holder, brings a legal action for damages based on the allegation that she would have received half of the annuity had the annuity owner not rejected the decedent’s change of beneficiary form and mailed the rejection notice to the decedent’s previous address

_________________________________________________________________________________________________________________________

What is the Typical Beneficiary Language in Settlement Agreements which include a Structured Settlement?

In the event of the death of Plaintiff/Payee, all guaranteed non-life contingent payments specified in Exhibit "A" to be made by Insurer's Assignee pursuant to the provisions of this agreement that have not been paid as of the date of Plaintiff/ Payee's death, shall continue to be paid on the dates specified therein to the Estate of Plaintiff/Payee or to any such person he may so designate. If all persons designated are not living at the time of Payee's death, such payments shall be made to the Estate of the Payee. Payee may request in writing that Assignee change the beneficiary designation under this Agreement. Assignee will do so but will not be liable, however, for any payment made prior to receipt of the request or so soon thereafter that payment could not reasonably be stopped. Neither such designation, nor any revocation thereof, shall be effective unless it is in writing and delivered to the Assignee. The designation must be in a form acceptable to the Assignee before such payments are made. Plaintiff/Payee, or a duly authorized representative of the Plaintiff/Payee, shall be responsible for maintaining accurate address, banking and mortality information with the Assignee.

__________________________________________________________________________________________________________________________

In May 2016, John Eutsler settled a personal injury claim with a third-party. SAC, ECF No. 21,¶ 7. The third-party then assigned its obligation to pay Eutsler to Defendant BHG (via a

qualified assignment). Id. at ¶ 8. BHG, in turn, purchased an Annuity Contract (the “Annuity”) from Defendant BHLN to fund its obligation to make periodic structured settlement payments to Eutsler. Id. The Annuity specifies that BHG is the “Owner” of the Annuity, Eutsler is the “Optional Payee,” and Defendant Kristin Barnett, Eutsler’s sister, is the “Contingent Payee.” Id. (citing a copy of the Annuity filed on the docket at ECF No. 3-5).

The SAC alleges that on April 19, 2019, Eutsler “changed the beneficiary of the Annuity from Barnett to both Ms. Vance as a 50% beneficiary and his mother, Lenora Eutsler, as a 50% beneficiary.” ECF No. 21, 23. Eutsler allegedly made this change by sending a notarized “Beneficiary Designation or Change Request form” to BHLN. Id. BHLN received the Change Request form but rejected it because it was filled out incorrectly. Id. at ¶ 24. BHLN attempted to notify Eutsler of the rejection but sent notice to his old address in Nevada despite knowing he had since moved to California. Id. Vance argues BHLN and BHG were negligent in that they did not notify Eutsler that his Change Request form was filled out incorrectly. Id. at ¶ 25, 37-41.

After Eustler died in an automobile accident November 22, 2019, pursuant to the Annuity’s beneficiary designation (and ignoring the rejected Change Request form) alleged Vance , BHG and BHLN made payments on the Annuity to Barnett. Id. at ¶ 33. Barnett has refused to give any portion of those payments to Vance. Id. Vance alleges BHLN and BHG’s continued payment to Barnett along with Barnett’s continued withholding of Annuity funds from Vance have caused Vance severe economic and emotional distress. Id. at ¶ 34.

Vance had previously argued she was a “third-party beneficiary” of the Annuity in the Complaint, ECF No. 1-4, ¶ 42. The Court rejected that argument. Order, ECF No. 11, 5. Then Vance argued she was an “intended beneficiary” of the insured, and that once “BHLN/BHG were put on notice by Mr. Eutsler that he wished to change his beneficiaries, BHLN/BHG had a duty of care/fiduciary obligation to [Vance].” Opp’n, ECF No. 26, 5. The Court opined that the semantic distinction between “third-party beneficiary” and “intended beneficiary” in the context of a structured settlement annuity makes no substantive difference. Vance cites no additional authority establishing an Annuity owner owes a duty of care to someone in Vance’s position, and the Court is not aware of any. The Court concluded that BHLN and BHG never owed a duty of care to Vance, and therefore they are not liable to Vance for negligence as a matter of law.

Fiancé's Claims of Conversion Against Decedent's Sister Failed

The Court stated that in California, conversion is the wrongful exercise of dominion over the property of another. Lee v. Hanley, 61 Cal. 4th 1225, 1240 (Cal. 2015). To prove conversion, Vance must therefore show (1) her ownership or right to possession of the property; (2) Barnett’s conversion by a wrongful act or disposition of property rights; and (3) damages. Id. Put differently, Vance “must establish an actual interference with [her] ownership or right of possession.” Moore v. Regents of the Univ. of Cal., 51 Cal.3d 120, 136 (1990) (citations omitted). “Where plaintiff neither has title to the property alleged to have been converted, nor possession thereof, [she] cannot maintain an action for conversion.” Id.

Vance’s SAC adds only the following to her conversion claim: “By way of Mr. Eustler’s desired change of beneficiary , Ms. Vance has the right to 50% of the annuity. By not allowing Ms. Vance 50% of the annuity, Ms. Barnett has engaged in a wrongful act by wrongfully exercising dominion over the property intended for Ms. Vance.” ECF No. 21, ¶ 76. However, the Court has already concluded “Vance is not a party or a third-party beneficiary” of the contract. Order, ECF No. 11, 6. Because Vance is not a party or a third-party beneficiary of the contract, she cannot argue she owns or has the right to possess the proceeds of that contract and therefore cannot establish Barnett committed conversion by exercising dominion over the Annuity proceeds.

The Court similarly ruled in favor of Defendants as to her claim for alleged Intentional Infliction of Emotional Distress.

#beneficiarystructuredsettlement #changebeneficiarystructuredsettlement #structuredsettlementbenefciary mantra

Last updated August 23, 2025