HOW DO STRUCTURED SETTLEMENTS WORK?

What are the steps in a structured settlement transaction?

HOW STRUCTURED SETTLEMENTS WORK?

What You Need To Know About How Structured Settlements Work in 2026

1. Structured settlements are negotiated not awarded

Structured settlements arise out of a negotiated compromise (or so-called “meeting of the minds”) in which part of the settlement includes a customized schedule of future periodic payments that match the Claimant’s or Plaintiff’s needs, and the life insurance companies that will issue the structured settlement annuities to fund the payment streams. In some cases, US Treasury Funded Structured Settlements, an alternative “qualified funding asset” permissible under IRC 130(d) may be used. How structured settlements work requires knowledge of how settlements are negotiated.

2. Constructive receipt must not have occurred.

A structured settlement cannot be established after constructive receipt or actual receipt has occurred (see Rev. Ruling 79-220), so regardless of which side of the case, you're on, it's a good idea to be prepared and engage the services of a structured settlement expert in advance. If a structured settlement is desired, be mindful if you are a claimant/plaintiff (or an attorney representing a claimant/plaintiff) not to sign a general release which sets forth as consideration, solely a cash amount, followed by the words "the receipt is hereby acknowledged"

3. Basic steps in the

structured settlement process:

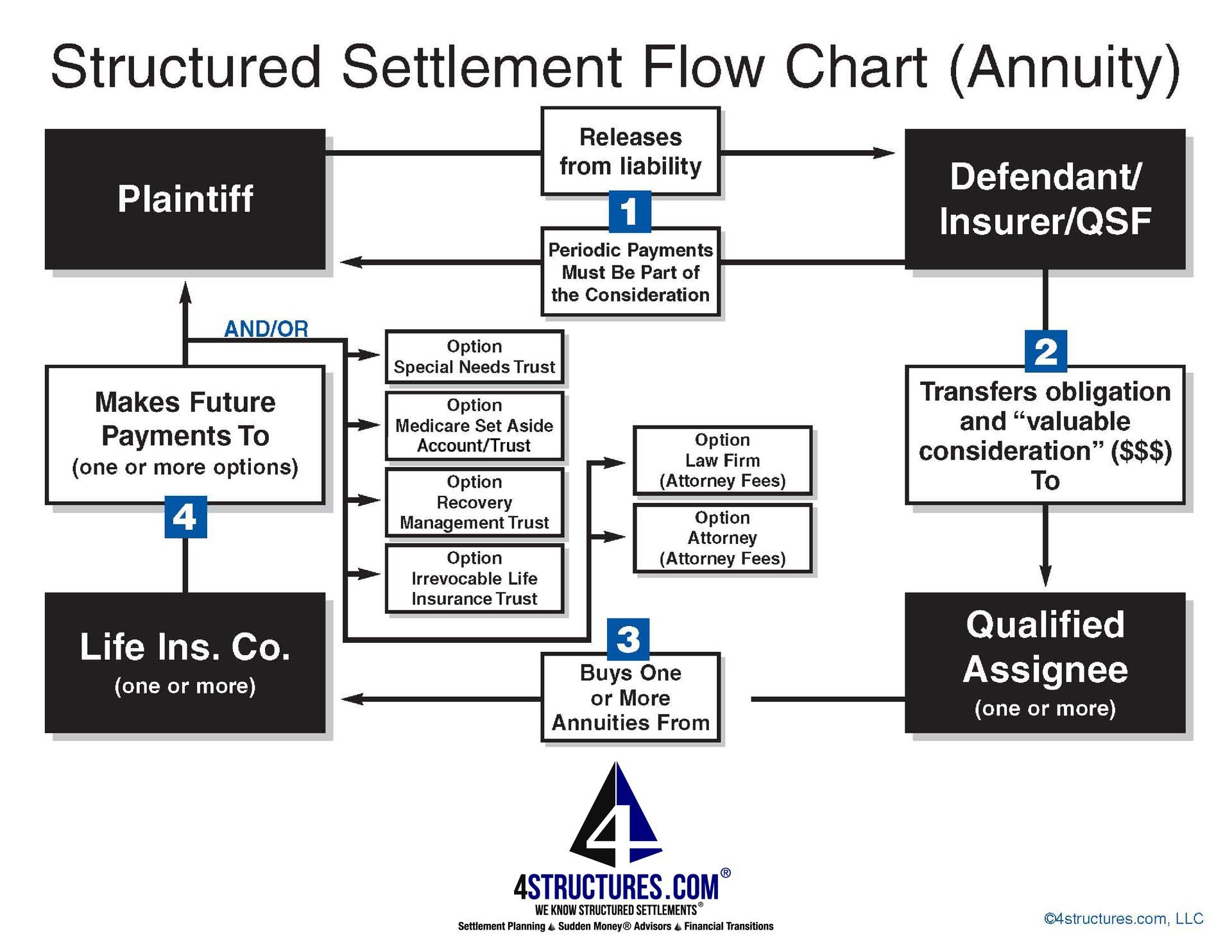

- Defendant, its Insurer or Qualified Settlement Fund (QSF) trustee - enter into a contractual agreement with Plaintiff/Claimant on a schedule of future periodic payments to the Plaintiff/Claimant, with all or a portion of the negotiated personal injury damages in exchange for a release. Plaintiff/Claimant agrees to release their claim(s) in exchange for the promise by the Defendant/Insurer or QSF Trustee to make one or more future periodic payments to claimant in addition to immediate cash items (for attorney fees, liens)

- Defendant, its Insurer or Qualified Settlement Fund trustee ( "Assignor") - makes a qualified assignment of its obligation to pay future periodic payments to Claimant/Plaintiff (or Trust for the benefit of Claimant/Plaintiff), to a Qualified Assignment Company, with the Plaintiff's consent. Subject to the requirements of IRC 130(c), the Defendant/Insurer or QSF Trustee pays the Structured Settlement Funding Amount to the Qualified Assignment Company. The Qualified Assignment Company assumes the obligation to make the periodic payments. The plaintiff agrees to look to the assignee as the obligor for the promised future periodic payments. It's intended to be a legal novation.

- The Qualified Assignment Company ("Assignee") receives the Structured Settlement Funding Amount from the Defendant/Insurer or QSF Trustee and uses these funds to purchase an annuity contract, or alternative permissible "qualified funding asset", in an amount sufficient to fund the periodic payment obligation it has assumed. The qualified assignment company owns the "qualified funding asset" and may either make payments itself or may direct that the annuity issuer makes the payments. If an alternative permissible "qualified funding asset" is used, there may be a segregated trust for each claimant that holds the alternative permissible "qualified funding asset". Here is a list of structured settlement annuity issuers and qualified assignment companies.

4. Very important reminder

These steps must occur without the Claimant/plaintiff being in

constructive receipt, or actual receipt , of the Structured Settlement Funding Amount. Once constructive receipt, or actual receipt, has occurred there can be no structured settlement.

Want to Know More About How Structured Settlements Work?

Call

888-325-8640

In some instances, particularly where the damages do not qualify for the income tax exemptions under IRC Sections 104(a)(1) and 104(a)(2), one can consider solving the problem via the use of a non-qualified assignment program.

All parties involved reach agreement as to the supporting documentation necessary for the completion of the settlement. In most cases, the documents will consist of the Settlement Agreement and Release, any required court orders or probate approvals, proof of birth (if payments are life contingent. Some carriers may also require proof of birth if the claimant/plaintiff/payee is a minor), and a qualified assignment agreement.

Important to Note

It's important to note that the structured settlements are one component of a greater settlement planning process and that depending on the facts of a particular case, a multiple disciplinary, multiple product solution may be appropriate.

Last updated December 24, 2025

HAVE MORE QUESTIONS ABOUT HOW STRUCTURED SETTLEMENTS WORK?

I'm here to help! Send me a message and I'll be in touch. Or click the number to call me at 888-325-8640