Structured Settlements with Inclusive Qualified Assignments

The purpose of a qualified assignment, the standard practice since the Periodic Payment Settlement Act of 1982, signed into law by President Reagan in January 1983, is to shift obligations to make future periodic payments from the Defendant, or his/her/its Insurer, to the qualified assignment company. See 26 U.S. Code § 130 - Certain personal injury liability assignments

Why is a Qualified Assignment Even Necessary or Desired?

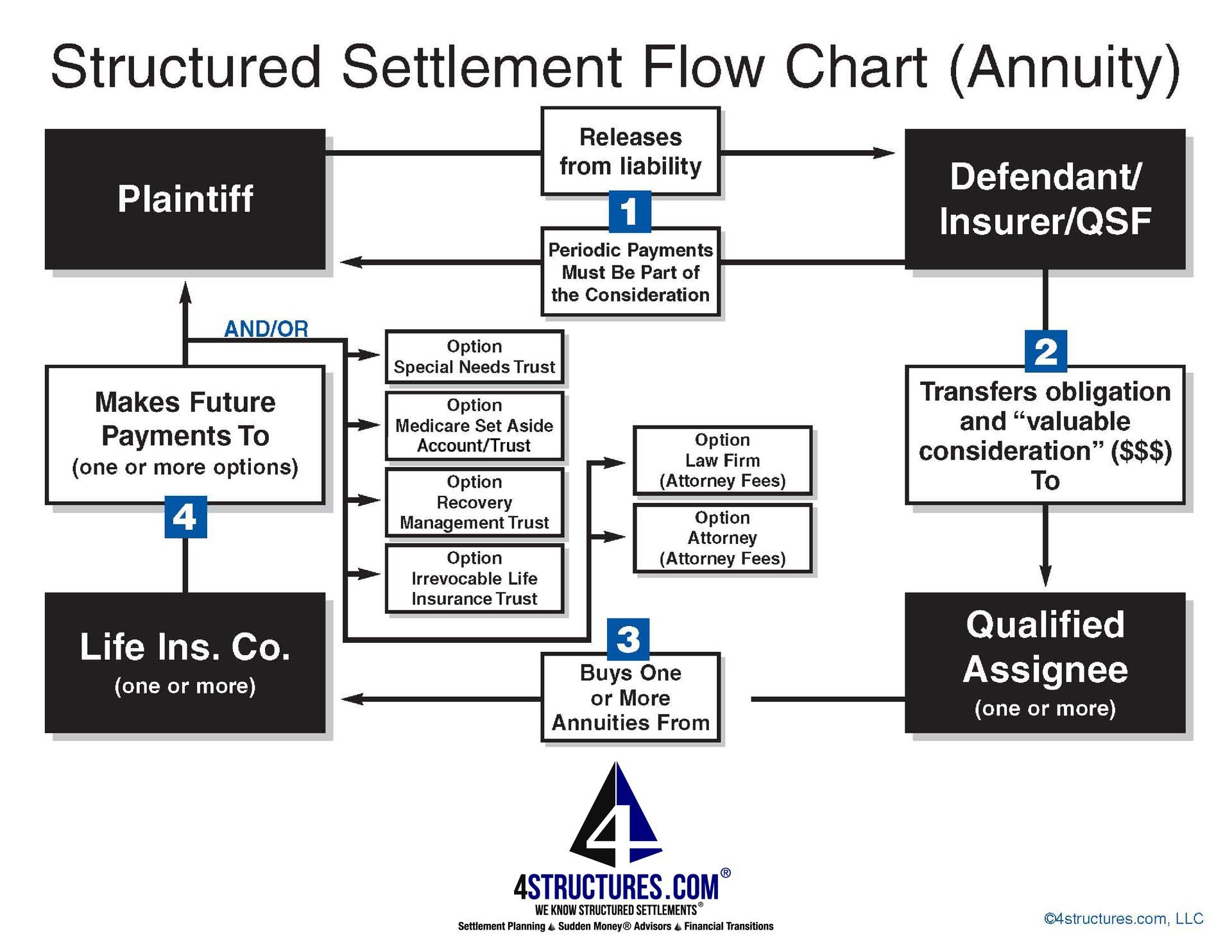

While they are generally willing to facilitate a structure, given that the total payout on a structured settlement will exceed the structured settlement funding amount, few Defendants or Insurers want to retain the contingent future periodic payment liability on their books. Neither would a qualified settlement fund trustee. A qualified assignment enables the Defendant or Insurer, or QSF trustee, to get a novation, with the qualified assignment company substituted as the obligor of the future periodic payments. See flow chart at the bottom of the post. Steps 2 and 3 show how a qualified assignment fits into the process of establishing a structured settlement.

A qualified assignment is battle tested. See Yerkes v. Cessna Aircraft Co., Civil Action No. 14-cv-05925 (D.N.J. Jun. 25, 2015). In short, Yerkes entered into a structured settlement was established in the 1980s as part of the settlement of an air crash case when Yerkes was a teenager. The periodic payment obligation was assigned by way of a qualified assignment to junk bond fueled First Executive Corporation. Then the structured settlement annuity was funded with junk bond fueled Executive Life Insurance Company of New York (ELNY) that was liquidated in 2013. As a result, some annuitants, including Yerkes, suffering shortfalls. Yerkes' attempt at recovering from the Defendant he had released in the 1980s and its London Market insurers failed. Yerkes has an action against his personal injury lawyers pending at the time of posting.

Inclusive Qualified Assignments

There are three types of Qualified Assignments

- Qualified Assignment (QA) NOT INCLUSIVE

- Qualified Assignment & Release (QAR) INCLUSIVE

- Qualified Assignment Release & Pledge (QARP) INCLUSIVE

All three forms of qualified assignment work in terms of substitution of obligors. In the context of this discussion about qualified assignments, the term "inclusive" refers to forms of qualified assignment that the plaintiff signs and is a party to. The use of the non-inclusive QA has not been the standard business practice in the structured settlement industry for many years. The requirement of the Plaintiff’s signature on the QAR or QARP means that the Plaintiff or Plaintiff’s representative can proofread and review the document before signing. As such it is an inclusive humanistic business practice that increases the trust in the transaction. At the very least the plaintiff has the opportunity to review the final document before signing.

Plaintiff and Defense oriented consultants often say "it is all about the plaintiff" in their messaging. While many settlement consultants regularly use the QAR or QARP, there are some consultants, including plaintiff consultants in conjunction with their staffs, who are surprisingly still using the QA. And it just may cause a problem one day if there is an error on the document that the plaintiff may have caught had they been given the opportunity to review the document and acknowledge with a signature, such as is required on the QAR and QARP.