Interest Rate Linked Structured Settlements (IRLSS)

Payments Adjust if Interest Rates Rise in the Future

"I've got sunshine on a cloudy day

Their cash is gone, My structure pays and pays

I guess you'd say

What can make me feel this way?

My IRLSS, MY IRLSS, My IRLSS"

I may not have the pipes of the late David Ruffin, Rock and Roll Hall of Famer, listed as one of the greatest singers of all time by Rolling Stone magazine in 2008 and 2023, however I'm sure you can appreciate my parody of The Temptations classic from the time that Ruffin was the lead singer. We all grapple with the financial temptations in life.

Rising rates and stock market volatility have made structured settlements increasingly attractive. Knowing now what you're going to get then is increasingly cool.

At he time of original publication of this post, I ran a USAA quote for a life annuity with 40 years certain structured settlement on a minor which bore an IRR of 4.71%.

For those that are interested in structured settlements, American General's Interest Linked Structured Settlement Annuity (IRLSS) presents an interesting solution that provides a potential upward adjustment if interest rates rise.

Traditional structured settlements may include deferred lump sum payments targeted to specific or random dates, to help fund things such as college tuition, buying or funding a down payment on a home or real estate investment, paying for a wedding, fund a child's education, fund or supplement retirement, or provide a source for future investment. Assuming that the payments represent tax exempt damages (i.e. personal physical injury or physical. sickness, workers compensation, wrongful death) the deferred lump sum payments are tax exempt. But the tax exemption does not apply to subsequent investments of the future lump sums after they've been paid.

The Interest Linked Structured Settlement Annuity addresses that issue using an objective formula that converts deferred lump sums to future income streams at prevailing rates on target dates if there has been an increase in reference interest rates. Deferred lump sum payment dates could be from 5 to 30 years for example and, if converted to an income stream, subject to the objective formula, they could be designed to pay for 5, 10, 15, 20 years and so on, instead of the lump sum. However if the conversion occurs it will be based on higher rates than existed when the annuity was established. Contrast the possibility of an IRLSS conversion with the standard lump sums that are based on the rates that exist at the time the annuity is established.

In Private Letter Ruling 202127039, the IRS concluded, in a minor's medical malpractice case that the periodic subject payments of damages that the Minor will receive are fixed and determinable as to amount and time of payment within the meaning of IRC 130(c)(2)(A) veen though they are calculated pursuant to an objective formula based on the performance of the 10-year United States Treasury Bond Yield Rate. In addition, the other requirements of IRC 130(c) have also been met. Accordingly, the assignment entered into pursuant to the Assignment Agreement in a qualified assignment under IRC 130(c).

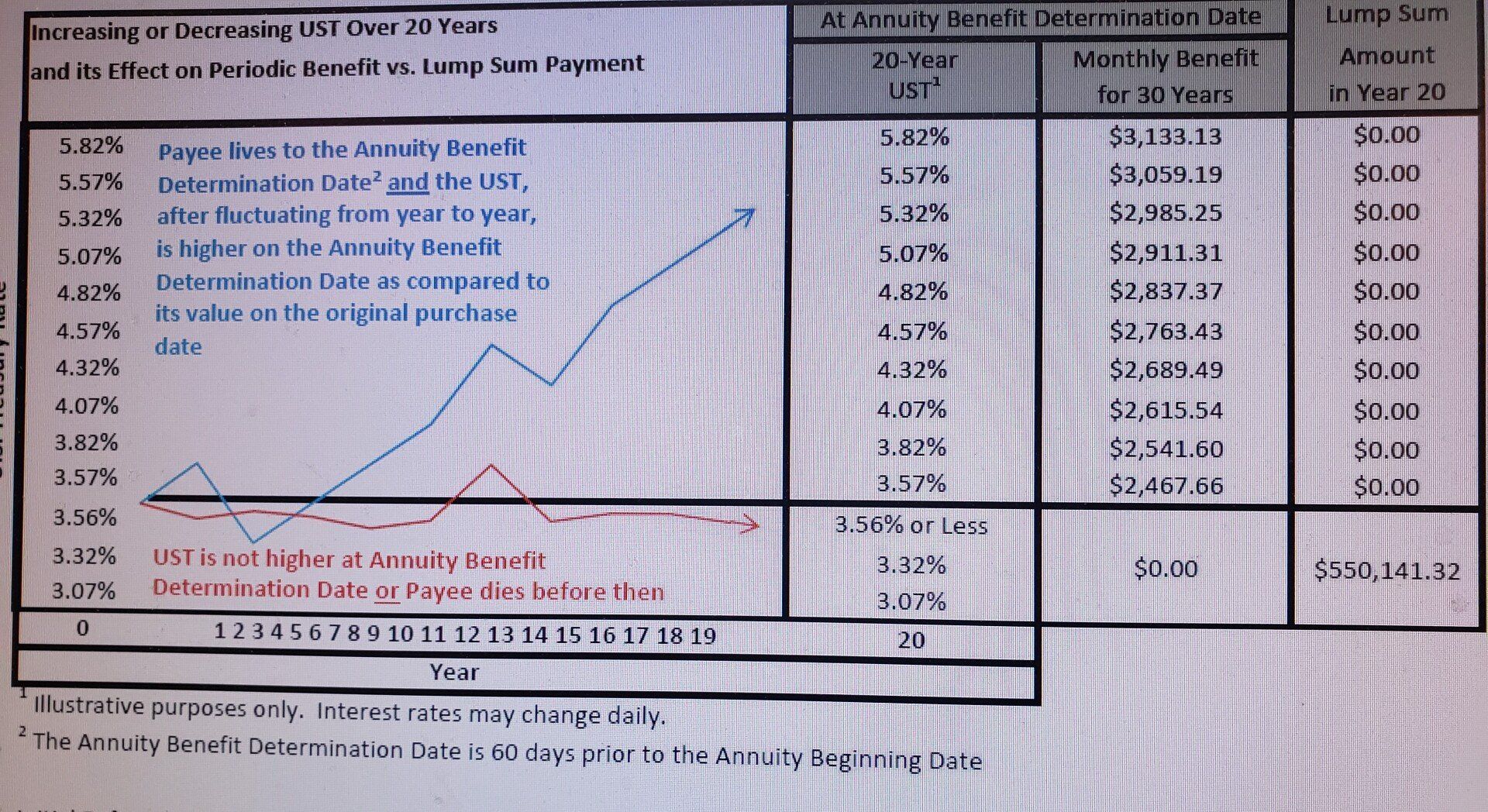

Here's an illustrative example of how the Interest Rate Structured Settlement works:

Purchase Date: 7/1/2022

Lock Date: 6/13/2022

Total Annuity Cost: $250,000.00

Owner State: TX

Reference Rate: 20-Year U.S. Treasury Bond Yield Rate Initial Reference Rate: 3.56%

Benefit Determination Date: 5/2/2042

Benefit A will be paid to the Payee through 6/1/2072 if

(1) the Single Measuring Life is living on the Beginning Date; and

(2) the current value of the Reference Rate on the Benefit Determination Date is greater than the Initial Reference Rate shown above. Otherwise Benefit B will be paid on 7/1/2042.

Benefit A

PERIOD CERTAIN: Beginning 7/1/2042 for 30 years guaranteed through 6/1/2072, a monthly benefit amount greater than the Minimum Payment Amount of $2,464.70.

If Benefit A will be paid, the table below shows the actual benefit amount for representative values of the Reference Rate on the Benefit Determination Date. Please refer to the Payment Schedule of the Contract for details of the calculation.

Benefit B

GUARANTEED LUMP SUM: $550,141.32 on 7/1/2042

In the years prior to 2022, during and following the Covid-19 pandemic were characterized by low interest rates relative to historical levels. A wide variety of market factors can cause interest rates to rise (as was the case begining in Q2 2022), including central bank monetary policy, rising inflation and changes in general economic conditions. However, there is no guarantee interest rates will increase at the time of a payout of this structured settlement product.

UST, or U.S. Treasury bills, notes and bonds are government debt securities that are offered as fixed income investments issued by the U.S. Department of the Treasury.

- Treasury Bills ("T-Bills") are issued for terms up to 1 year.

- Treasury Notes are issued for terms of 2, 3, 5, 7 and 10 years.

- Treasury Bonds are issued for terms of more than 10 years.

They are all typically referred to as “Treasuries.” There is no assurance that products based in whole or in part on U.S. Treasuries will provide positive investment returns.

What Happens if a United States Treasury Rate is Not Available?

At the time of the Annuity Benefit Determination Date, if the U.S. Treasury rate is not available, a similar bond of similar maturity length will be used as a replacement rate. Such rate will be whatever the current U.S. government debt security that is available at that time or the safest fixed rate available in the absence of a U.S. government guarantee. Treasury Notes and Treasury Bonds may change on a daily basis. Please consult your attorney and/or your advisers as the Initial Reference Rate and the rate which may be implemented at the Annuity Benefit Determination Date are subject to various market factors on any given day. The Interest Rate Linked Structured Settlement is not a security and is not a direct investment in any U.S. Treasury Bonds. Investment in the Interest Rate Linked Structured Settlement will result in benefits that will vary based on future interest rates and the benefit stream selected.

IRLSS is not available in New York

IRLSS are Issued by American General Life Insurance Company (AGL), based in Houston, Texas. The IRLSS product is not available in New York at time of the most recent update.

AGL is responsible for financial obligations of insurance products and is a member of Corebridge Financial, Inc. (formerly AIG Life & Retirement), which was rebranded as a standalone company following an Initial Public Offering completed in September 2022). Guarantees are backed by the claims-paying ability of the issuing insurance company. Products may not be available in all states and product features may vary by state.

Last updated January 19, 2024