Ask the Structured Settlement Expert

WHAT IS A STRUCTURED SETTLEMENT?

Customized stable income for plaintiffs, to pay for damages in personal injury, wrongful death, pay workers' compensation claims and other types of settlements, to address what most people most worry about

WHAT IS A STRUCTURED SETTLEMENT?

A Structured Settlement Is...

A structured settlement is a negotiated customized stream of periodic payments:

- paid as damages in exchange for a release of liability to resolve a lawsuit, claim, or dispute

- that is customized to the needs of personal injury victims, wrongful death survivors and their families.

A structured settlement is often funded with an annuity, but unlike other deferred annuties or income annuities, a structured settlement annuity can have multiple payment streams to address multiple needs in a single contract.

What Does a Structured Settlement Do?

A structured settlement addresses the thing that most people most worry about the most. Money.

Take your pick from examples of common money worries:

- Having enough money

- Having enough money to comfortably pay your bills

- Having enough money to comfortably pay medical bills for you, your , child or your spouse.

- Having enough to pay for college, or help pay for college

- Having enough so that you dont have to share an apartment with 4 friends because you can't otherwise afford it.

- Having enough money to be able to take the job that doesn't pay as much as the others, but has a great training program and great long term career potential.

- Having enough income for a comfortable retirement

- Having enough income to maintain a lifestyle

- Having enough to pay for potential custodial care oran accute care facility, which are not usually covered by medical insurance?

- How to pay the cost of of long term care insurance or life insurance?

Money worries occur all along the age and wealth spectrum.

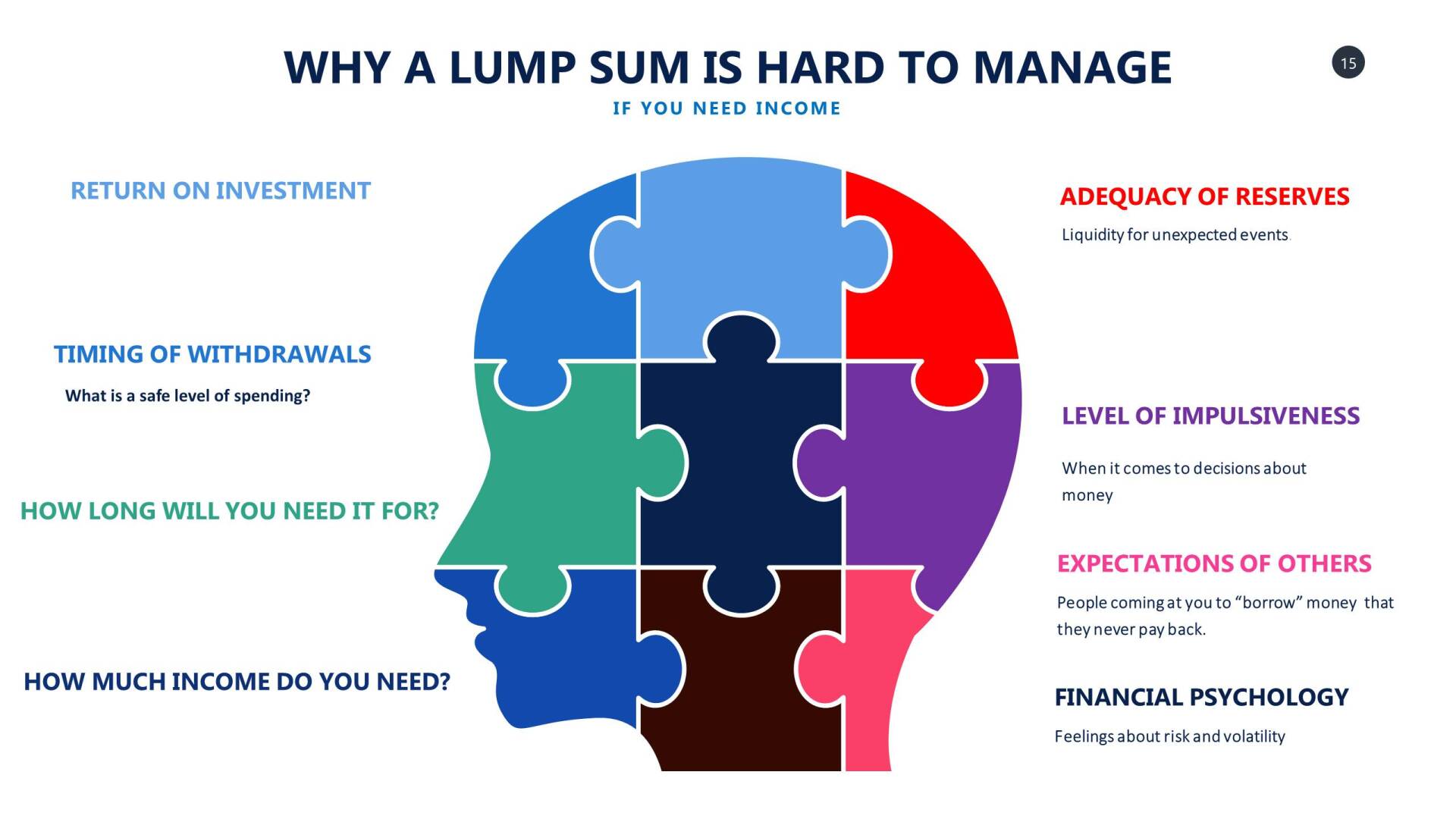

Why is a lump sum settlement hard to manage?

The inevitable question "lump sum or structured settlement?" is one faced by many plaintiffs. It may come up at mediation or when the case settles. However, it is not an either/or answer because many times both a structured settlement and a lump sum is the answer.

A lump sum can be difficult to manage if you need income. There are many things that come into play such as:

- how much income you need?

- how long you need the income for (a certain number of years or for your lifetime, or perhaps even the lifetime of you and your spouse; enough to make sure there is guaranteed money to help raise the children)

- timing of withdrawals

- return on investment

- adequacy of reserves and liquidity for unexpected events

- the tendency to make impulsive purchases or decisions about money

- financial psychology

Consider the image on this page, which illustrates the dilemma faced by someone with a lump sum of cash.

- What is a safe level of spending?

- How should the money be invested?

- How do I feel about risk and volatility?

- What is a safe level of income to draw down from the lump sum, to make sure it does not run out before you do?

Emotions come into play, magnified by the reality that those funds were derived from a physical injury or sickness or the wrongful death of a loved one,

What is Sequencing Risk? Can Structured Settlements Help? (4structures.com)

A Structured Settlement is a Stable Pathway Forward and Core Personal Injury Settlement Planning Tool

As a volatility buffer, a structured settlement is a stable pathway forward and an important core financial planning tool available to parties in personal injury, wrongful death and workers compensation litigation, that provides essential income stability with tax advantages. Protect your legal settlement recovery with a structured settlement and create or augment a stable financial core.

When the settlement of claims represent payment of damages for personal physical injury or physical sickness, wrongful death, workers compensation and the settlement is structured using a qualified funding asset (a single premium structured settlement annuity , or a trust fund that invests only in obligations of the United States government ), the periodic payments are income tax-free. There are also index linked and other market based options.

Ethical Use of Periodic Payments

May Help Facilitate Settlement

A structured settlement, if ethically and effectively used, is an innovative negotiation and settlement planning tool that provides significant benefits to all parties in litigation and may help parties to facilitate settlement.

When are Structured Settlement Payments Income Tax-Free?

By agreeing to a structured settlement as part of their claim or lawsuit recovery, claimants or plaintiffs can receive future periodic payments income tax-free , if their periodic payments qualify under §104(a)(1), as amounts received under workmen’s compensation acts as compensation for personal injuries or sickness; or the amount of any damages (other than punitive damages) received (whether by suit or agreement and whether as lump sums or as periodic payments) on account of personal physical injuries or physical sickness under §104(a)(2) of the Internal Revenue Code.

Definition of Structured Settlement in the Internal Revenue Code

A structured settlement definition appears in the Internal Revenue Code, at §5891(C) (1), as "an arrangement"—

(A) which is established by (1) suit or agreement for periodic payment of damages excludable from gross income of the recipient under §104(a)(2), or (ii) agreement for periodic payment of damages under any workers’ compensation law excludable from gross income of the recipient under §104(a)(1), and

(B) under which the periodic payments are (i) of the character described in subparagraphs (A) and (B) of §130(c)(2), and (ii) payable by a person who is a party to the suit or agreement or the workers’ compensation claim or by a person who has assumed the liability for such periodic payments under a qualified assignment in accordance with §130...

Internal Revenue Code §139F (wrongful incarceration/wrongful conviction)

How Do You Get a Structured Settlement?

Structured settlements are available in all 50 states. But you cannot buy a structured settlement annuity for yourself. To be eligible to receive a structured settlement, you must be a plaintiff in a lawsuit. If not in suit, you must be the claimant. As part of a settlement, a contingency fee plaintiff's or claimant's attorney may also structure or defer their legal fees .

PRO TIP

Constructive or actual receipt of settlement proceeds must not have occurred.

Don't sign a release which includes the words "receipt of which is hereby acknowledged" if a structured settlement is desired for you, your spouse, children, your ward, or your client

Please read our section How Structured Settlements Work. Structured Settlement annuities are only placed by or in conjunction with structured settlement brokers and consultants who hold active life insurance licenses (annuities, which are issued by life insurance companies, are grouped into this category for regulatory purposes) and are authorized by the insurers that issue the structured settlement annuities. Note that even if someone markets themselves to you as a settlement planner, they are acting in the capacity as agent or broker when placing, or co-broking a structured settlement. In New York State, individuals or companies holding life broker licenses may also act as structured settlement consultants, but may not be appointed by the annuity issuer. Such brokers and consultants are generally paid a one-time commission or share of the commission, by the annuity issuer(s), or co-broker, for placing the structured settlement annuity or other funding asset. Generally, state insurance law prohibits rebating of commissions.

4structures.com® LLC hopes that you find this website helpful in learning what is a structured settlement and how a structured settlement may be used effectively on your client’s case as part of an overall settlement plan or financial transition plan. Simply call 888-325-8640 or email if you like and we will be ready to answer your questions about structured settlements, market based structured settlements (a/k/a investment backed structured settlements), Treasury Funded Structured Settlements, settlement planning or other Sudden Money and settlement management issues.

Alternate Uses of the Term “Structured Settlement”

While the term "structured settlement" is formally and traditionally applied to a settlement for payment of damages involving physical injury, physical sickness or workers compensation (where damages or claims are excluded from gross income to the extent set forth in the statute), the colloquial usage may include a similar approach involving taxable damages using a non-qualified assignment, or periodic payment reinsurance. Click on the bolded words for more details.

#whatisastructuredsettlement #whatarestructuredsettlements #structuredsettlement #structuredsettlements #structuredsettlementinformation #structuredsettlementdefined #definitionofstructuredsettlement #newyorkstructuredsettlements #Westchesterstructuredsettlements #ctstructuredsettlements #volatilitybuffer #structuredsettlementdefinition

#stamfordstructuredsettlements

Last updated May 11, 2025

Contact John Darer about Structured Settlements

Have a question about structured settlements? I'm a structured settlement expert and here to help you. Call me at 888-325-8640, or send me a message and I'll be in touch.